Business

3 days after resumption, Port-Harcourt refinery ‘suspends’ operations

Published

4 months agoon

By

Ekwutos Blog3 days after resumption, Port-Harcourt refinery ‘suspends’ operations

Barely three days after the much-publicized reopening of the Port Harcourt Refinery, operations appear to have been suspended.

According to Ekwutosblog, workers and residents near the refinery revealed that there was no activity, neither was loading taking place at the facility’s bays.

Although the Nigeria National Petroleum Company Limited (NNPCL) launched the new plant earlier this week, claiming that hundreds of trucks were loading daily, sources revealed that the trucks carried leftover products from storage, not newly refined fuel.

Investigations also revealed that the refinery is undergoing calibration, which will delay operations until the process is complete.

Workers on-site disclosed that the existing products—referred to as “dead stock”—require separation and cleaning before new supplies can be processed.

During a visit, the facility appeared deserted, with idle trucks and inactive machinery.

Sources also disclosed that calibration will continue into next week before major operations, including kerosene and diesel loading, can resume.

When asked about the lack of loading activity, a worker in overalls said, “They are de-watering, removing the water under the PMS. Maybe there will be loading after that, but we don’t know what time today.”

Another one said: “They are calibrating the meters,”

A major source spoke, “Before the refinery was shut down between 2015/2016, we had dead stock left in the tank, including some Premium Motor Spirit (petrol) DPK (kerosene), and Automated Gas Oil (diesel).

“So, these products were in large quantities in stores in those tanks. During the rehabilitation of the Port Harcourt Refinery, Old Area 5, those products were evacuated from the tanks for storage.

“But for DPK, it is in large quantity but they have not pushed it from the tank where it was kept after refined ready for commercial purposes.

“So, the product that was loaded was dead stock, that is the old product that was in the system. So, after these dead stocks, they will have to clean the tank, remove all the debris before pumping the new project into that tank, and redye it.

“But what they are trying to do at the Port Harcourt Refinery is manual, which cannot match the new digital pumps. Most of the pumps used for the event were refurbished.”

You may like

25 YEAR OLD FASHION DESIGNER ALLEGEDLY POISONED BY HIS GIRLFRIEND AT MARINE BASE, PORT HARCOURT

Chelsea ‘breach UEFA limits on financial losses’, could be banned from Europe

Federal High Court in Abuja has set April 10 as the date to hear a case asking for the removal of Vice Admiral Ibok-Ete Ekwe Ibas as Sole Administrator of Rivers State.

NATIONAL POLICE DAY: PREPARATIONS REACH CLIMAX; POLICE ENGAGE IN NATIONWIDE WALKATHON As IGP calls for inclusive policing in Nigeria.

Uzodimma congratulates Christian Voice Newspaper on 25th Anniversary …As his Commissioner, Chief Press Secretary, others bag distinguished media personality award

Violence, Police Collusion As Alleged Ukachukwu’s Thugs Block APC Accreditation In Awka.

Business

Dangote refinery, NNPC: More fuel stations increase pump price in Nigeria

Published

1 day agoon

April 4, 2025By

Ekwutos Blog

The price of Premium Motor Spirit, popularly known as fuel, has recorded a significant increase in the past days, which may worsen the economic hardship Nigerians face.

MRS, a filling station partner of Dangote Refinery, kicked off the latest fuel price increase when it adjusted its petrol pump to between N925 and N950 per litre in Lagos and the Federal Capital Territory, Abuja.

Similarly, other fuel marketers such as Empire Energy, Recoil, Juda Oil, Total, Emedab, and others also increased their fuel pump to between N950 and N970 per litre.

On Wednesday, the Nigerian National Petroleum Company Limited retail outlets also jacked up their fuel price to N950 per litre from N880 in Abuja.

Summarily, Ekwutosblog observed motorists will have to pay N70 more to buy a litre of petrol in the coming days.

The development comes amid the suspension of petrol product sales in Naira by Dangote Refinery. This follows the initiation of the naira-for-crude sale deal between Dangote Refinery and the federal government through NNPCL.

On Wednesday, President Bola Ahmed Tinubu announced a reshuffling of NNPCL.

Meanwhile, local oil prices are increasing in Nigeria, despite the decline in global crude prices. As of the time of this report, United States West Texas Intermediate was at $62.15 per barrel, down from above $65, while Brent crude stood at $65.42 per barrel, down from $72 last week.

Business

Global Billionaires’ Net Worth Plummets by $65 Billion Amid Market Downturn

Published

2 days agoon

April 4, 2025By

Ekwutos Blog

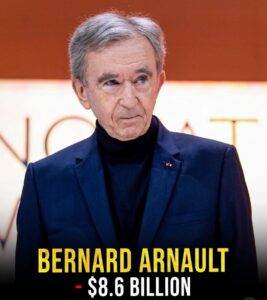

In a significant setback, the world’s wealthiest individuals collectively lost over $65 billion in net worth today, as key market sectors experienced a sharp downturn.

This decline affected prominent figures in technology, finance, and other industries, sending shockwaves through financial markets.

Ekwutosblog reports that the downturn occurs amidst cautious optimism that new US policies may not be as severe as initially feared.

However, the immediate impact has already been felt, leading to a decline in the net worth of billionaires such as Elon Musk, Warren Buffett, and Jeff Bezos, amongst others who have significant stakes in tech, finance, and other industries.

The global billionaire population has been growing, with over 2,850 individuals representing almost $15 trillion in wealth.

Despite this growth, the market downturn serves as a reminder of the volatility and risks associated with wealth concentration.

Business

Sterling Bank Makes History: Scraps Transfer Fees for Local Online Transactions, Earns Praise from Lawmakers, Including Mohammed Bello El-Rufai, and the Public

Published

2 days agoon

April 3, 2025By

Ekwutos Blog

Sterling Bank has taken a groundbreaking step to ease the financial burden on Nigerians by eliminating transfer fees and other charges for local online transactions.

This move is a significant stride towards financial inclusion and customer-centric banking, particularly during a time when economic pressures are high.

Ekwutosblog gathered that this initiative has been commended by Mohammed Bello El-Rufai, Chairman of the House Committee on Banking Regulations, who praised Sterling Bank’s commitment to creating a more accessible and equitable banking system.

El-Rufai encouraged other financial institutions to follow Sterling Bank’s example, emphasizing that a competitive banking sector prioritizing Nigerians’ interests will strengthen the economy and rebuild public trust in financial services.

Sterling Bank’s decision to scrap transfer fees is expected to benefit individuals and small business owners who frequently make online transactions. The bank’s customers can now perform local transfers via the mobile app without incurring any charges. Obinna Ukachukwu, Growth Executive at Sterling Bank, stated that access to one’s own money shouldn’t come with a penalty, highlighting the bank’s values-driven approach to customer-centric banking.

This move has sparked widespread public approval, with many calling on other banks to adopt similar policies.

As policymakers, El-Rufai reiterated their commitment to fostering a regulatory environment that encourages pro-customer initiatives while ensuring sustainability within the banking sector.

25 YEAR OLD FASHION DESIGNER ALLEGEDLY POISONED BY HIS GIRLFRIEND AT MARINE BASE, PORT HARCOURT

Chelsea ‘breach UEFA limits on financial losses’, could be banned from Europe

Federal High Court in Abuja has set April 10 as the date to hear a case asking for the removal of Vice Admiral Ibok-Ete Ekwe Ibas as Sole Administrator of Rivers State.

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment5 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics5 months ago

Politics5 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics5 months ago

Politics5 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.