Business

Breaking News: Guinness announces plan to leave Nigeria after 75 years as Tinubu’s inflation wreaks economic havoc!!!

-

Politics10 months ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.

-

Business10 months ago

Business10 months agoInflation hits record high of 29.90% on naira weakness

-

Politics7 months ago

Politics7 months agoBREAKING: Federal Gov’t Offers To Pay Above N60,000, Reaches Agreement With Labour

-

SportsNews10 months ago

SportsNews10 months agoOlympic Qualifiers 2024: CAF Confirms Dates For Super Falcons Vs Banyana Banyana

-

Politics10 months ago

Politics10 months agoGovernor Hope Uzodinma’s New Cabinet In Imo: The Gainers, The Losers

-

Entertainment10 months ago

American Singer Beyonce makes history as first Black woman to top country chart

-

Politics7 months ago

Politics7 months agoBREAKING: Organized Labour suspends strike for one week.

-

Business10 months ago

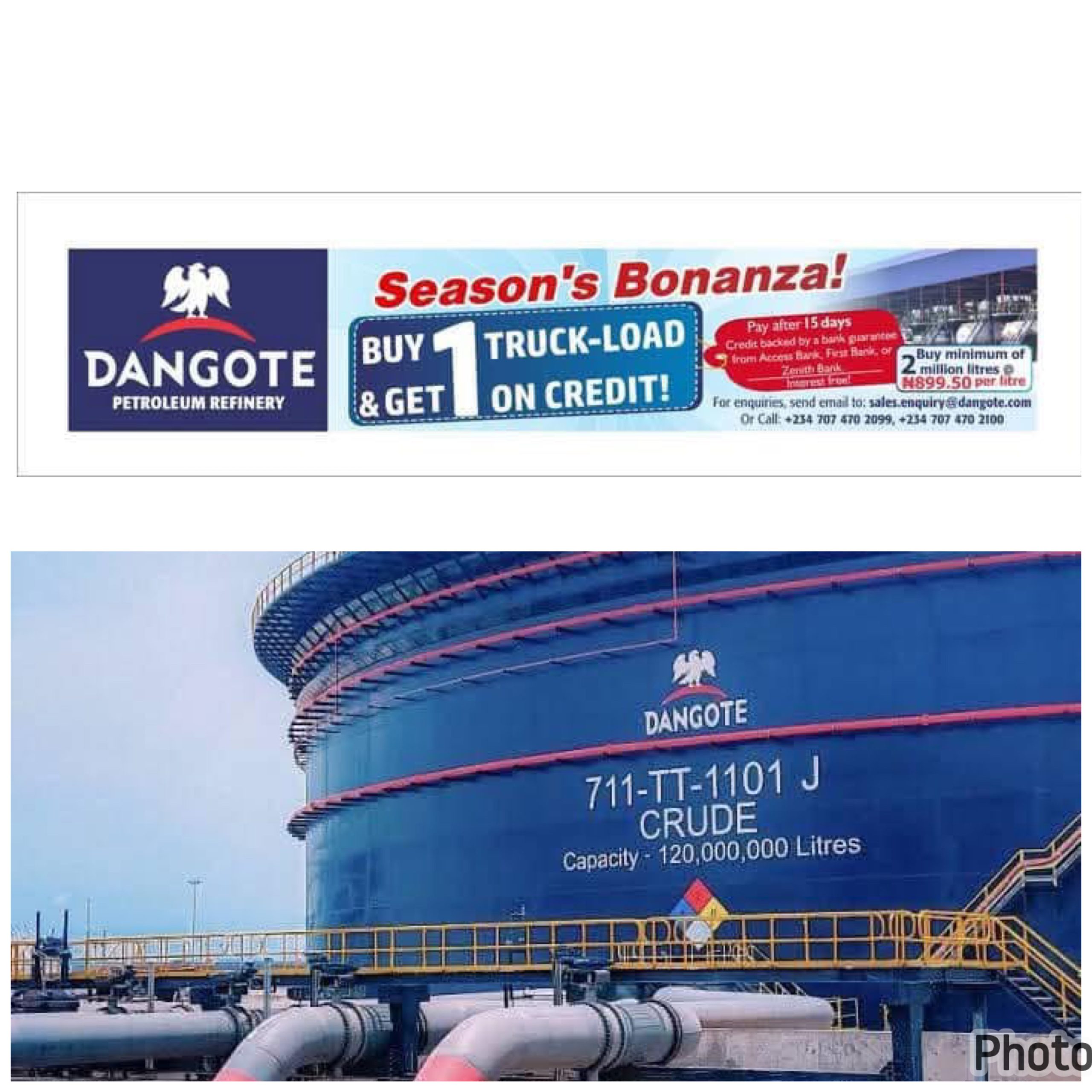

Reasons we cannot sell cement below N7,000, by Dangote, Bua, Lafarge