Business

NNPCL to release N15bn worth of products to Marketers after DSS intervention.

Published

3 months agoon

By

Ekwutos Blog

A peace agreement has been reached between the Nigerian National Petroleum Company Limited (NNPCL) and independent oil marketers, following a mediation led by the Director General of the Department of State Services (DSS), Adeola Ajayi.

The agreement will see NPCL allow the loading of products to cover the N15 billion owed to the marketers.

Chinedu Ukadike, the National Publicity Secretary of the Independent Petroleum Marketers Association of Nigeria (IPMAN), disclosed the outcome during an interview with newsmen.

The meeting, which included a director from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and NNPCL’s Group Chief Executive Officer, Mele Kyari, facilitated a resolution, allowing independent marketers to resume product loading.

Ukadike explained, “We were invited by the DSS Director to mediate the ongoing dispute between IPMAN and NNPCL over issues including pricing and the non-compliance of Dangote Refinery in selling Premium Motor Spirit (PMS) to IPMAN. After a successful mediation, NNPCL agreed to reduce some charges and allow marketers to immediately load tickets worth N15 billion.”

Additionally, Ukadike revealed that MDPRA agreed to issue IPMAN import licenses, enabling the association to embrace full deregulation of the oil sector.

However, NMDPRA spokesperson George Ene-lta stated he was unaware of the meeting or any license approvals, saying, “I was not part of it.” Meanwhile, NMDPRA has committed to making a payment of N10 billion to oil marketers as part of the outstanding funds under the Petroleum Equalisation Fund (PEF).

You may like

Even our prophets have felt president Tinubu’s impact. Most Men of God Who Used To Prophecy What Will Happen Have Just Gone Silent – Shehu Sanni

New Year: Yahaya Bello Receives Governor Ododo’s Parents

27-year-old woman allegedly k!lls her husband with pestle in Niger State

TRENDING: Smoking cigarettes, drinking alcohol are not sins – Pastor Abel Damina

New Year: Peter Obi pays visit to IBB to discuss national issues

Vikings who invaded Britain were actually returning to their homeland

Business

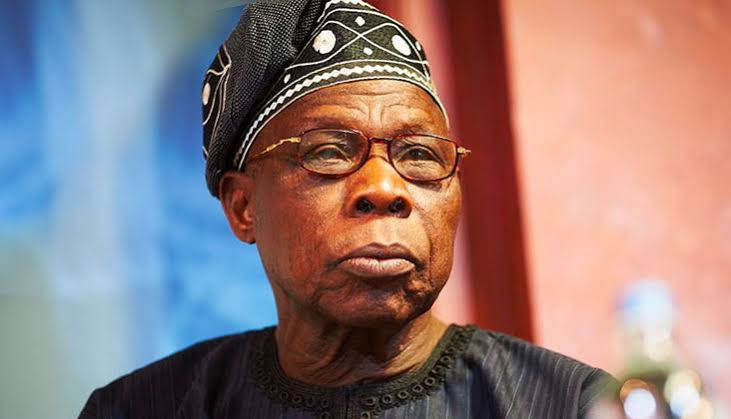

NNPC INVITES OBASANJO TO INSPECT PORT HARCOURT REFINERY.

Published

11 hours agoon

January 2, 2025By

Ekwutos Blog

The Nigerian National Petroleum Company Limited(NNPCL)has invited former President Olusegun Obasanjo to visit the Port Harcourt Refinery.

This follows his recent comments questioning its functionality.

Obasanjo had referenced concerns raised by Shell Petroleum Development Company (SPDC)about potential corruption affecting the refinery’s operations.

He also claimed that NNPCL had misrepresented the refinery’s operational status.

In response,NNPCL’s Chief Corporate Communications Officer, Mr. Olufemi Soneye, offered Obasanjo the chance to tour the refinery, emphasizing the company’s commitment to openness.

Soneye highlighted that the refinery had undergone extensive rehabilitation, going beyond previous turnaround maintenance to a complete overhaul.

Soneye also invited Obasanjo to join NNPCL’s efforts to strengthen Nigeria’s energy security.

He clarified that NNPCL had transformed into a profit-driven private entity,moving away from its previous loss-making status.

Additionally,Soneye addressed reports claiming that NNPCL would cease crude oil supply to Dangote Refinery,dismissing them as false.

Business

Ukraine to end transit of Russian gas into Europe

Published

1 day agoon

January 1, 2025By

Ekwutos Blog

Russian gas supplies to Europe via Ukraine are to end on Wednesday, when a five-year deal between Ukraine’s gas transit operator Naftogaz and Russia’s Gazprom expires.

Ukrainian President Volodymyr Zelensky said his country would not allow Russia to “earn additional billions on our blood” and had given the EU a year to prepare.

The EU has significantly reduced imports of gas from Russia since it launched its full-scale invasion of Ukraine in 2022, but a number of eastern member states still depend largely on the supplies, making Russia about €5bn ($5.2bn; £4.2bn) a year.

The European Commission said the continent’s gas system was “resilient and flexible” and that it had sufficient capacity to cope with the end of transit via Ukraine.

Russian gas made up less than 10% of the EU’s gas imports in 2023, according to figures from the bloc, compared to 40% in 2021.

But several EU members, including Slovakia and Austria, continue to import significant amounts of gas from Russia.

Austria’s energy regulator said it did not forecast any supply disruption as it had diversified sources and built up reserves.

But Ukraine’s decision has already caused serious tensions with Slovakia, which is now the main entry point of Russian gas into the EU and earned transit fees from piping the gas on to Austria, Hungary and Italy.

On Friday, Slovakia’s Prime Minister Robert Fico – who had just made a surprise visit to Moscow for talks with Russian President Vladimir Putin – threatened to stop the supply of electricity to Ukraine.

This prompted Mr Zelensky to accuse him of helping Mr Putin “fund the war and weaken Ukraine”.

“Fico is dragging Slovakia into Russia’s attempts to cause more suffering for Ukrainians,” the Ukrainian president said.

Poland has offered to support Kyiv in case Slovakia cuts off its electricity exports – supplies that are crucial to Ukraine, whose power plants come under regular attack from Russia.

Moldova – which is not part of the EU – could be seriously affected by the end of the transit agreement. The gas fuelled a power plant on which Moldova relies for most of its electricity needs. It also supplied the Russia-backed breakaway region of Transnistria, a small sliver of land sandwiched between Moldova and Ukraine.

Moldova’s energy minister, Constantin Borosan, said the government had taken steps to ensure stable power supplies to the country but called on citizens to save energy. A 60-day state of emergency in the energy sector has been in place in Moldova since mid-December.

President Maia Sandu accused the Kremlin of “blackmail” possibly aimed at destabilising her country ahead of a general election in 2025. The Moldovan government also said it had offered aid to Transnistria.

Main gas pipelines across Europe

Ukraine to end transit of Russian gas into Europe

© BBC

Russia has transported gas to Europe through Ukraine since 1991.

As the EU has reduced its dependence on Russian gas, it has found alternative sources in liquefied natural gas (LNG) from Qatar and the US as well as piped gas from Norway.

Once the Ukrainian transit route is cut off, the Black Sea’s TurkStream – which reaches Turkey, Hungary and Serbia – will be the only Russian gas supply to European countries.

In December, the European Commission laid out plans it said would enable EU member states to entirely replace gas transiting through Ukraine.

Under the EU’s contingency plans, affected countries will be supplied with Greek, Turkish and Romanian gas from the Trans-Balkan route, while Norwegian gas will be piped through Poland. More supplies will also reach central Europe through Germany.

Business

16 large US cities where house prices are set to soar the most in 2025

Published

3 days agoon

December 31, 2024By

Ekwutos Blog

Homeowners and prospective buyers can expect to see housing prices soar to unprecedented heights in 16 cities across the US, analysts have predicted.

House prices are expected to rise by 3.7 per cent across America next year, which is comparable to the rate they’ve climbed since 2012, Realtor.com has forecasted.

However, forecasters with the real estate website have also predicted that 16 large metropolitan areas will see even higher rates of home appreciation in 2025.

Florida has dominated the forecast with five cities in the sunshine state expected to have price growth rates in the double digits.

But the southwest region – which includes Arizona, Colorado, and Nevada – of the country will get the highest boom in housing prices, according to the forecast.

Phoenix is expected to see the most significant growth in nation in 2025, with analysts predicting a 13.2 per cent price growth estimate, followed by Colorado Springs and Tucson as 12.7 per cent and 12.4 per cent, respectively.

Despite the anticipated home price growth, analysts predict that mortgages rates will keep mortgage payments relatively unchanged in the coming year.

The markets, however, are anticipating lower tax rates and higher economic growth under the incoming Trump Administration, which forecasters predict could result in an increase in disposable household income.

Analysts also note that if the country has both income growth and lower tax rates, houses could become more affordable in 2025 than they were in previous years.

Florida has dominated the 2025 housing price forecast with five cities in the sunshine state expected to have price growth rates in the double digits. Pictured: Lido Key Beach in Sarasota

But the southwest region – which includes Arizona , Colorado , and Nevada – of the country will get the highest boom in housing prices, according to the forecast. Phoenix is expected to see the most significant growth in nation in 2025

A majority of the metropolises that are expected to see a housing price boom next year saw some of the most dramatic increases between 2020 and 2022.

Preston Zeller, Chief Growth Operator at BatchService, a company specializing in real estate data and insights, told DailyMail.com that housing prices soared during this two-year period of ‘low rates and high moving rates from other states’.

Consequentially, these areas saw ‘more of a correction’ when rates started going up in 2022 and 2023, he added.

‘Boom/bust cities like Las Vegas and Phoenix have weathered particularly well due to far West Coast migration patterns to neighboring states,’ Zeller said, adding: ‘Of course Boise and surrounding areas have felt this as well.’

He urged home buyers ‘get their finances in gear right now’, warning that the start of the year may be slow, but by spring and summer one can expect a ‘mad dash for purchasing’.

However, Robert Washington, a Florida-based broker at Savvy Buyers Realty, says he does not expect Florida houses to rise as drastically as forecasters predict.

‘I think we will see a steady increase in prices in our area, but I don’t believe they will soar by any means,’ Washington – whose territory includes three Florida markets that made the Realtor.com list – told DailyMail.com.

Citing how housing prices in the area have ‘come down’ in recent months, Washington predicted prices will increase, but only by a range of 3 to 5 per cent.

‘Demand does already feel like it is picking up leading into the new year. Some of the hurricane stigma feels like it is beginning to fade which certainly helps,’ he admitted.

Washington added: ‘If mortgage rates drop throughout 2025, I think we will see sustained buying activity with modest price increases.’

Here are the 16 cities where Realtor.com analysts expect home prices to soar next year:

1. Phoenix, AZ

Phoenix, the capital city of Arizona, is forecast to have the largest increase in home appreciation in 2025. Realtor.com analysts estimate the city will see a price growth of 13.2 per cent and a sales growth of 12.2 per cent

Phoenix, the capital city of Arizona, is forecast to have the largest increase in home appreciation in 2025.

Realtor.com analysts estimate the city will see a price growth of 13.2 per cent and a sales growth of 12.2 per cent.

Phoenix is the most populous city in Arizona and is home to 1.65million people, according to latest census data.

It is known for its year-round sunshine and warm temperatures and boasts a booming job market as well. It’s job market boomed at nearly 12 percent growth since 2019 and became an attractive migration spot for those coming from California, according to a recent report by The National Association of Realtors.

Phoenix also boasts a relatively low cost of livingas well as housing affordability, with the average home value sitting at $414,977, according to the report.

2. Colorado Springs, CO

Analysts expect Colorado Springs to see a price growth of 12.7 per cent and sales growth of 27.1 per cent in 2025, according to Realtor.com

Analysts expect Colorado Springs to see a price growth of 12.7 per cent and sales growth of 27.1 per cent in 2025, according to Realtor.com.

Colorado Springs, a city situated at the eastern foot of the Rocky Mountains, currently has a median housing sale price of just under half-a-million dollars.

Realtor.com predicts the price will double within the decade, with the city just an hour south from Denver.

The city, which in 2023 recorded a population of 488,664 people, is known for its hiking trails and stunning parks, including Pike National Forest.

3. Tucson, AZ

Realtor.com analysts predict Tucson will see an estimated 12.4 per cent growth in home prices next year. They also expected sales growth to rise by 12.5 per cent

Tucson is the second-largest city in Arizona and his home to 542,629 people, according to 2020 US Census data.

Realtor.com analysts predict Tucson will see an estimated 12.4 per cent growth in home prices next year. They also expected sales growth to rise by 12.5 per cent.

Like Phoenix, which is situated more than 100 miles away, Tucson has become a popular relocation destination due to its nice weather, beautiful desert landscapes and growth in industries like aerospace and defense.

The city is also known for its affordable cost of living, diverse culture, arts scene and outdoor leisure activities.

Housing costs in Tucson are also around 25 per cent cheaper than the national average, according to certified financial planner Andrew Latham.

4. Boise City, ID

Boise, Idaho will see a home price growth of 12.3 per cent and sales growth of 2 per cent in 2025, Realtor.com has forecasted

Boise is the capital city of Idaho and home to 235,421 people, according to population data recorded last year.

The city will see a home price growth of 12.3 per cent and sales growth of 2 per cent in 2025, Realtor.com has forecasted.

The city, which is home to Boise State University, is known for its parks, hiking trails, hot springs, rock climbing and outdoor activities, including skiing and river sports.

Boise, touted for its relatively low cost of living, also offers residents cultural experiences, including museums, shopping, and its arts and culinary scenes.

5. Las Vegas, NV

Analysts estimate that housing prices in Las Vegas will grow by 12.3 per cent in 2025 and that sales will grow by 5.5 per cent

Las Vegas is the most populous city in Nevada and home to 660,929 residents. The city is internationally renowned for its resorts and casinos.

In addition to its shopping, fine dining, and entertainment offerings, Las Vegas earned its ‘Sin City’ nickname due to the prevalence of money crimes, prostitution, and violence in the city.

Las Vegas has benefited from the same west coast migration patterns as Phoenix and Realtor.com analysts expect that growth to continue in the new year.

They estimate that housing prices will grow by 12.3 per cent in 2025 and that sales will grow by 5.5 per cent.

6. Orlando, FL

Orlando, located in Florida, is expected to see house prices grow by 12.1 per cent in 2025, according to Realtor.com’s forecast. The city will also see home sales grow by an estimated 15.2 per cent

Orlando, located in Florida, is expected to see house prices grow by 12.1 per cent in 2025, according to Realtor.com’s forecast.

The city, which had a population of 307,573 at the 2020 census, will also see home sales grow by an estimated 15.2 per cent.

Orlando is home to more than a dozen theme parks, most notably being Walt Disney World which is comprised of several parks.

Universal Studios is also a popular tourist destination, offering visitors access to the Wizarding World of Harry Potter.

7. Ogden, UT

The mountainous town of Ogden, Utah is located just north of Salt Lake City and home to a population of 87,267 people. Realtor.com has estimated that house prices in Ogden will grow by 11.8 per cent next year, with sales expected to rise by 2.2 per cent

The mountainous town of Ogden, Utah is located just north of Salt Lake City – the state capital – and home to a population of 87,267 people.

Realtor.com has estimated that house prices in Ogden will grow by 11.8 per cent next year, with sales expected to rise by 2.2 per cent.

Ogden has been dubbed a ‘gateway’ to popular ski resorts including Snowbasin, Powder Mountain and Nordic Valley.

Visitors can experience hands-on history at Ogden’s George S. Eccles Dinosaur Park, which features life-size dinosaur models and a paleontology lab.

The city is also home to multiple museums and historic Prohibition-era speakeasies that are now popular shopping and dining hubs.

8. Tampa, FL

Housing costs have been on the rise for several years in Tampa, with Realtor.com now expecting prices to grow again this year by 11.8 per cent. Analysts also predict sales growth rates to rise by 9.1 per cent

Tampa is situated along Florida’s Gulf Cost and despite being a major business center, is known for its museums, cultural offerings and access to multiple beaches.

The city had an estimated population of 403,364 in 2023, according to census data, and offers residents a cost of living that is 3 per cent lower than the national average.

The sunshine state, in addition to its warm weather, appeals to Americans looking to lower their annual tax liability, as it is one of the few states that does not impose income tax at the state level.

Housing costs have been on the rise for several years in Tampa, with Realtor.com now expecting prices to grow again this year by 11.8 per cent.

Analysts also predict sales growth rates to rise by 9.1 per cent.

9. Deltona/Daytona Beach, FL

Daytona Beach, which is situated on Florida’s Atlantic coast, is expected to see house prices rise by 11.5 per cent in 2025, according to Realtor.com

Daytona Beach, which is situated on Florida’s Atlantic coast, is expected to see house prices rise by 11.5 per cent in 2025, according to Realtor.com.

Forecasters have also predicated house sales to grow by 7.2 per cent.

Daytona Beach has a population of 82,485 people.

The city, which has been dubbed a popular spring break destination, is also known for its annual Daytona 500 NASCAR race.

10. Memphis, TN

Forecasters predict that house prices in Memphis, Tennessee will grow by 10.5 per cent in 2025, according to Realtor.com. They also expect sales to rise by 8.3 per cent

Forecasters predict that house prices in Memphis, Tennessee will grow by 10.5 per cent in 2025, according to Realtor.com. They also expect sales to rise by 8.3 per cent.

Memphis, which is situated on the Mississippi River, is known for its influential blues, soul and rock ‘n’ roll musicians, including Elvis Presley, B.B. King and Johnny Cash.

The city is home to 618,639 residents and a popular tourist destination, with many music lovers coming to the area to visit Presley’s Graceland mansion.

11. Sarasota, FL

Realtor.com has predicted that home prices in Sarasota, Florida will increase by 10.4 per cent next year, with sales expecting to grow by 3.2 per cent

Sarasota is located on the Gulf Coast of the sunshine state and home to an estimated 57,602 people, according to 2020 census data.

The state’s population has climbed over the last decade, having grown from 51,917 at the 2010 census.

Like other coastal cities in Florida, Sarasota offers the appeal of warm weather, beaches and numerous cultural institutions.

Realtor.com has predicted that home prices in Sarasota will increase by 10.4 per cent next year, with sales expecting to grow by 3.2 per cent.

12. Lakeland, FL

Realtor.com analysts predict a house price growth of 10.3 per cent in Lakeland, Florida next year, with sales rising by 10.6 per cent.

Lakeland, Florida is located 36 miles east of Tampa and 55.5 miles west of Orlando.

The city is home to 122,264 residents, according to recent census data, and is bets known for its many lakes.

Florida Southern College is located in Lakeland and the Detroit Tigers also conduct their spring training at a facility in the city.

Realtor.com analysts predict a house price growth of 10.3 per cent in Lakeland next year, with sales rising by 10.6 per cent.

13. Atlanta, GA

Atlanta is the capital of Georgia and the state’s most populous city. Realtor.com expects house prices to grow by 10.2 per cent in 2025, with sales estimating to grow by 15.1 per cent

Atlanta is the capital of Georgia and the most populous city in the state with 510,823 residents, according to the last US Census.

The metropolis is home to several businesses, including Coca Cola, has one of the largest aquarium in the country, and is headquarters to CNN.

Realtor.com expects the city’s house prices to grow by 10.2 per cent in 2025, with sales estimating to grow by 15.1 per cent.

Atlanta played an important roles in both the Civil War and the 1960s Civil Rights Movement and is home to the Martin Luther King Jr. National Historic Site.

14. Austin, TX

Realtor.com predicts that house costs in Austin, Texas will rise by 10.2 per cent in 2025. Forecasters have also predicted sales growth of 14.5 per cent

Realtor.com predicts that house costs in Austin, Texas will rise by 10.2 per cent in 2025. Forecasters have also predicted sales growth of 14.5 per cent.

Austin, the capital of Texas, is home to 979,882 residents, according to recent census data.

The city is home to the University of Texas’ flagship campus and is best known for its eclectic live-music scene, including the annual South by Southwest festival.

Austin is a popular destination for hiking, biking, swimming and boating. Formula One has also hosted the United States Grand Prix just south of the city.

15. Durham, NC

Houses in Durham, North Carolina are expected to become 10.1 per cent more expensive in 2025, according to Realtor.com. Analysts at the firm also predict house sales to grow by 14.1 per cent

Houses in Durham, North Carolina are expected to become 10.1 per cent more expensive in 2025, according to Realtor.com.

Analysts at the firm also predict house sales to grow by 14.1 per cent.

Durham, recorded a population of 283,506 in the 2020 census, making it the fourth-most populous city in North Carolina.

It is best known for its science and technology companies, as well as its educational institutions.

16. San Antonio, TX

House appreciation is expected to rise to 10 per cent in San Antonio next year, according to Realtor.com. Home sales in the popular Texas city are also expected to grow by 6.7 per cent

House appreciation is expected to rise to 10 per cent in San Antonio next year, according to Realtor.com.

Home sales in the popular Texas city are also expected to grow by 6.7 per cent.

Even our prophets have felt president Tinubu’s impact. Most Men of God Who Used To Prophecy What Will Happen Have Just Gone Silent – Shehu Sanni

New Year: Yahaya Bello Receives Governor Ododo’s Parents

27-year-old woman allegedly k!lls her husband with pestle in Niger State

Trending

- Politics11 months ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.

Business11 months ago

Business11 months agoInflation hits record high of 29.90% on naira weakness

Politics7 months ago

Politics7 months agoBREAKING: Federal Gov’t Offers To Pay Above N60,000, Reaches Agreement With Labour

SportsNews10 months ago

SportsNews10 months agoOlympic Qualifiers 2024: CAF Confirms Dates For Super Falcons Vs Banyana Banyana

Politics10 months ago

Politics10 months agoGovernor Hope Uzodinma’s New Cabinet In Imo: The Gainers, The Losers

- Entertainment11 months ago

American Singer Beyonce makes history as first Black woman to top country chart

Trending2 months ago

Trending2 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

Politics7 months ago

Politics7 months agoBREAKING: Organized Labour suspends strike for one week.