Business

Access Bank strengthens digital lending platform

Published

9 months agoon

By

Ekwutos Blog

Access Bank has revamped its digital loan platform ’QuickBucks’, to boost lending to its consumers.

A statement from the bank on Monday said that since the introduction of its first digital PayDay loan in 2017, Access Bank had issued 18 million digital loans amounting to over N740bn.

It noted that with the revamp of the platform, customers could access loans for businesses, vehicle financing, and school fee payments, among others.

Speaking at the relaunch event, the Group Head of Consumer Banking, Access Bank, Njideka Esomeju, said, “Many Nigerians are facing financial challenges due to the economic situation in the country. At Access Bank, our goal is to enable every Nigerian to achieve financial freedom, which is why we introduced digital lending solutions.

“Initially, our digital loans were limited to salary earners with a 30-day repayment term. Now, QuickBucks Loans offer up to 12 months of repayment time for customers with salary accounts, self-employed individuals, active account holders, as well as business and trader account holders.”

According to Esomeju, the bank’s interest rates are among the lowest in the industry, ranging from about 5 per cent to a maximum of 15 per cent, depending on the type of loan.

She added that QuickBucks Loans are designed for ease of access, noting, “

The Unit Head of Digital Lending, Access Bank, Efe Obaigbena, also emphasised the purpose and improvements of QuickBucks Loans.

Obaigbena said, “These loans are designed to address our customers’ urgent financial needs. Since its launch in 2017, QuickBucks Loans have seen significant enhancements. As a responsible lender, we ensure our customers do not face excessive debt by capping our loans at a percentage of salary or account transactions. Eligibility also requires a good credit record across all financial institutions.”

The Lead of Digital Lending, Access Bank, Oladisun Dawodu, highlighted the bank’s commitment to integrating fintech innovations.

He noted, “Access Bank embraces fintech culture to distinguish itself in the market. We are preparing for future advancements such as AI-based lending solutions, blockchain technology for secure transactions, and closer integration with financial ecosystems.

“We are investing in technology and strategic actions to ensure QuickBucks Loans remain competitive and responsive to these developments.”

According to Dawodu, QuickBucks Loans are attractive because they are automated.

“Getting a QuickBucks Loan is quick and easy, and so is repaying it. Customers just need to make sure they have enough money in their account on the due date(s) and the payment will be deducted automatically, without any hassle. Our customer support team will also contact you with messages and calls as your due date approaches,” he explained.

You may like

Business

AFDB REAFFIRMS $2.2 BILLION PLEDGE AS VP SHETTIMA COMMISSIONS 2ND SAPZ IN CROSS RIVER ** Says agro-industrial processing zones will empower farmers, attract investors, diversify Nigeria’s economy

Published

21 hours agoon

April 10, 2025By

Ekwutos Blog

STATE HOUSE PRESS RELEASE

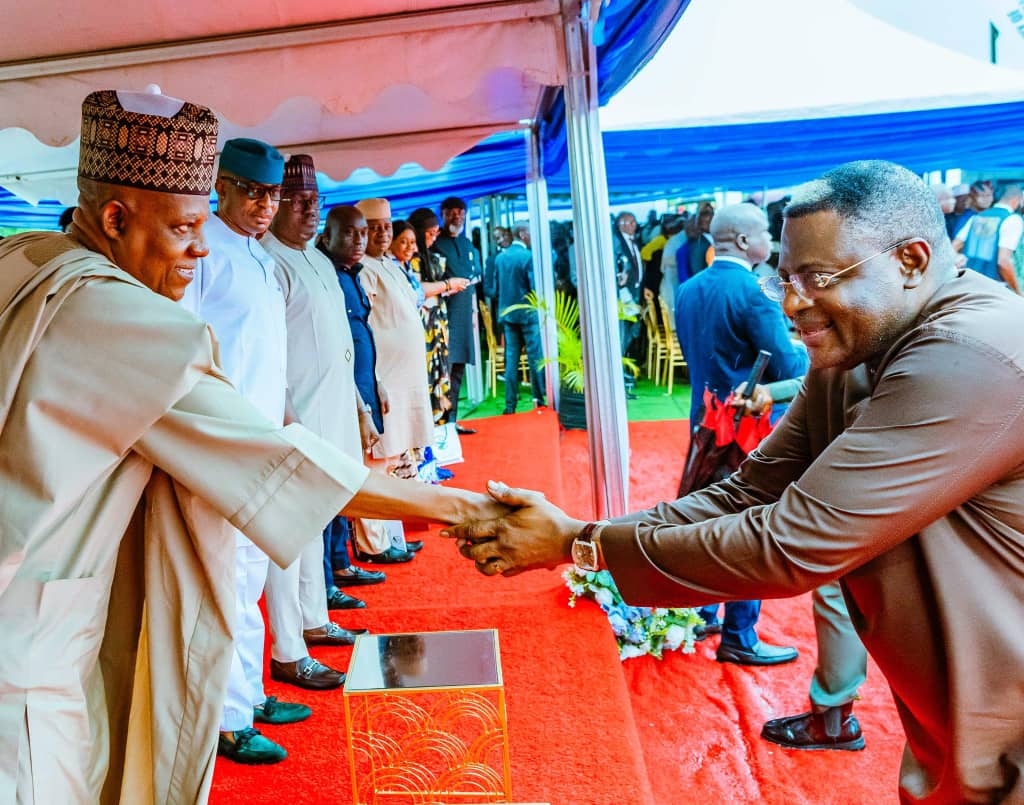

AFDB REAFFIRMS $2.2 BILLION PLEDGE AS VP SHETTIMA COMMISSIONS 2ND SAPZ IN CROSS RIVER

** Says agro-industrial processing zones will empower farmers, attract investors, diversify Nigeria’s economy

The federal government has commenced construction of the Special Agro-Industrial Processing Zone in Calabar, Cross River State, as part of a nationwide drive to transform the agricultural sector and stimulate inclusive economic growth across Nigeria.

This is the second of such a facility initiated within 72 hours after Vice President Kashim Shettima had on Tuesday performed the groundbreaking ceremony for the construction of the Kaduna State SAPZ in the Chikun local government area of the state.

Already, the AfDB_Group has reaffirmed its commitment to mobilising an additional $2.2 billion to execute the second phase of the SAPZ project across 28 states in Nigeria.

Speaking on Thursday when he performed the groundbreaking ceremony of SAPZ in Calabar, the Vice President described the project as “a game changer” that aligns with the President Tinubu administration’s Renewed Hope Agenda, aimed at diversifying the nation’s economy, addressing food security, tackling rural unemployment, as well as empowering farmers and the youth population.

“There is no intervention more practical in our dream of a nation where the potential of agriculture is maximised than what’s brought us together today. This isn’t just a project—it’s a bold vision to transform Nigeria’s agricultural value chain,” VP Shettima said.

According to him, the SAPZ initiative, supported with counterpart funding from development partners and the private sector, is designed to address challenges that have long hindered the growth of Nigeria’s agricultural economy, including inadequate processing infrastructure, limited access to markets, and rural unemployment.

“For far too long, our farmers have contended with poor infrastructure, lack of access to finance, and inadequate processing facilities. This zone is designed to confront those challenges head-on by creating an ecosystem where innovation, investment, and collaboration thrive,” he noted.

VP Shettima explained that the Calabar SAPZ will serve as a hub for agro-processing and storage, providing farmers and agripreneurs with critical infrastructure to scale their operations and tap into local and international markets.

“This is where farmers will meet with private investors, where ideas will turn into enterprise, and where our youth will find meaningful opportunities,” he said, disclosing that the Tinubu administration has classified SAPZ as a priority program in Nigeria’s quest for food security, with plans to institutionalize it as a government agency that will facilitate agricultural industrialization across all 36 states.

“These zones will generate thousands of jobs. They will create opportunities for young people, empower them with skills and knowledge to engage in meaningful work and help them contribute positively to the economy. Cross Riverians, development has come to your doorstep. For you and for the country, SAPZ is a game changer—one that will enable Nigeria to diversify its economy with a sustainable source.,” he stated.

Senator Shettima also expressed gratitude to key international development partners, including the African Development Bank, the Islamic Development Bank, and the International Fund for Agricultural Development, for their support and belief in Nigeria’s vision.

The Vice President commended Cross River State Governor, Senator Prince Bassey Edet Otu, for his collaboration, describing him as “a critical foundation for the success of this intervention and a great ally in development.”

Earlier, Cross River State Governor, Senator Otu, said the programme marked a watershed in the ongoing bid by his administration to establish the renewable resource base of the state through the full utilisation of agriculture and its multiple value chain.

Otu pointed out that in Cross River State, the establishment of a cluster of smallholder farmers in cash crops such as rice, cassava, millet, and cocoa across the state is the right step towards the agro-industrial revolution.

He said the paradigm shift from a non-renewable to a renewable resource base also holds the key to the prosperity of many nations, hence the imperative to join the league of sub-nationals in Nigeria that have adopted agriculture as the mainstay of their economy.

“The deliverables of the envisaged projects are food security, diversification of the state economy towards export-oriented trajectory and increase in the State’s GDP. When these projects are fully operational there is an expected robust collaboration with reputable agro-based processing institutes, universities and the rest, aimed at accelerating breakthroughs in many agro-industrial production.”

Also, Minister of Agriculture and Food Security, Senator Abubakar Kyari, said the programme would transform the agricultural production and agro-investment landscape in Nigeria under the Renewed Hope Agenda of President Tinubu.

Kyari thanked Vice President Shettima for his leadership and political backing at the highest level in the implementation of the SAPZ in Nigeria, just as he also commended the Governor of Cross River State for his commitment to ensuring that the state is among the front-running states that will commence the construction of their Agro-Industrial Processing Hub.

In his remark, President of AfDB, Dr Akinwumi Adesina, reiterated the bank’s pledge to mobilise $2.2 billion to execute the SAPZ project in 28 states across Nigeria.

Adesina observed that Cross River State has a significant role to play in Nigeria’s agricultural transformation because of the vast production of cocoa, cassava, rice and banana in the state, saying Obudu Cattle Ranch alone can turn the state into a huge livestock producer.

He also acknowledged that the state is ideal for SAPZ because it has an export processing zone, ports facility, and export handling capabilities, adding that the SAPZ in Calabar can easily be linked to the seaport for the transportation of processed agricultural commodities to the export market in neighbouring countries, including Cameroon and the rest.

“The African Development Bank, as you know, is spearheading this together with our partners, which include the Islamic Development Bank and the International Fund for Agricultural Development, and we have put together $934 million from the African Development Bank, with core financing of $938 million from these partners.

“The first phase of SAPZ in Nigeria will be in eight states of Cross River, Kaduna, Kano, Katsina, Oyo, Ogun, Kwara, Imo and the Federal Capital Territory. We are delighted with our partnership with the Islamic Development Bank and the International Fund for Agricultural Development.

“We have put together a financing package of $510 million to make this work. We expect, in the second phase of this, to mobilise $2.2 billion to be able to work for 28 states across the federation with several partners,” the AfDB President said.

Stanley Nkwocha

Senior Special Assistant to The President on Media & Communications

(Office of The Vice President)

10th April, 2025

Business

Tariff war could reduce US-China goods trade by 80% – WTO DG, Okonjo-Iweala

Published

1 day agoon

April 10, 2025By

Ekwutos Blog

The Director-General of the World Trade Organization, Ngozi Okonjo-Iweala has said the US-China tariff war could cut trade in goods between the two economic giants by 80 percent, pulling down the rest of the world economy.

Okonjo-Iweala said this in a statement on Wednesday.

Ekwutosblog reports that US President Donald Trump raised tariffs on China to 125 percent on Wednesday as the world’s two largest economies fought over retaliatory levies.

“The escalating trade tensions between the United States and China pose a significant risk of a sharp contraction in bilateral trade. Our preliminary projections suggest that merchandise trade between these two economies could decrease by as much as 80 percent,” she said.

According to her, the United States and China together accounted for three per cent of world trade and warned that the conflict could severely damage the global economic outlook.

Trump, even as he slapped further tariffs on China, paused higher tariffs on the rest of the world for 90 days after dozens of countries reached out for negotiations.

Okonjo-Iweala warned that the world economy risked breaking into two blocs, one centred around the United States and the other China.

“Of particular concern is the potential fragmentation of global trade along geopolitical lines. A division of the global economy into two blocs could lead to a long-term reduction in global real GDP by nearly seven percent,” she said.

She, therefore, urged all WTO members to address the challenge through cooperation and dialogue.

A few hours earlier, the US president ramped up duties on Chinese goods to 104 percent, only to hike them further when China retaliated by raising tariffs on US imports to 84 percent.

Trump, in a social media post announcing the moves, said China had been singled out for special treatment because of the lack of respect that China has shown to the World’s Markets.

Business

FCCPC Urges Nigerians to Report Harassing Loan Apps and Businesses

Published

4 days agoon

April 7, 2025By

Ekwutos Blog

The Federal Competition and Consumer Protection Commission (FCCPC) is advising Nigerians to report any loan apps or businesses that engage in harassing behavior over unpaid loans.

According to the FCCPC, no consumer should live in fear of harassment or intimidation.

Ekwutosblog gathered that Consumers can file complaints with the FCCPC through their website or contact their customer service hotline.

The FCCPC is responsible for protecting consumer rights and promoting fair competition in Nigeria.

FCCPC has taken steps to regulate digital money lenders and enforce consumer protection laws, including fining Meta and WhatsApp $220 million for violating the Federal Competition and Consumer Protection Act (FCCPA) and the Nigeria Data Protection Regulation (NDPR)

To file a complaint, follow these steps

Visit the FCCPC website and fill out the complaint form. Provide detailed information about the harassment, including dates, times, and communication records. Submit supporting documents, such as screenshots or messages. FCCPC Website: https://fccpc.gov.ng/ Customer Service Hotline: 0805 600 2020, 0805 600 3030

Email: mailto:contact@fccpc.gov.ng

Moment helicopter crashed into Hudson River in New York (VIDEO)

APC Can’t Take Anambra Like Edo, Imo and Kogi— Gov Chukwuma Soludo

List of ambassadorial nominees not ready – Foreign Affairs Ministry

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.