Business

Asian markets track Wall St record as Hong Kong, Shanghai stabilise

Published

6 months agoon

By

Ekwutos Blog

Asian markets tracked a record day on Wall Street Thursday, with Shanghai and Hong Kong supported by a Chinese central bank move to boost liquidity for major stock-buyers.

The yen sat around two-month lows after taking a hit in the wake of minutes showing Federal Reserve decision-makers were split on last month’s bumper interest rate cut while a top official sparked questions about how many more could be in the pipeline.

Chinese investors were settling down after a volatile start to the week that saw mainland and Hong Kong markets whipsaw as the euphoria over last month’s stimulus was dampened by a news conference that failed to unveil more measures or give details on those already announced.

Traders welcomed news that the People’s Bank of China had released details of a “swap facility” that will allow “qualified securities, funds and insurance companies” to access more than $70 billion in liquidity to purchase equities.

The move, one of a number of measures announced last month, helped Shanghai rise more than one percent at one point, having dived more than six percent Wednesday — its worst day in more than four years.

Hong Kong was up more than two percent, building on the previous day’s advance that followed a more than nine percent plunge, its heftiest in 16 years.

Dealers are now keenly awaiting a Saturday news conference on fiscal policy by the finance ministry, though observers warned the bar would be high for Finance Minister Lan Fo’an if he is to get the recent market rally back on track.

The gains led a rally across Asia, which came after the Dow and S&P 500 chalked up fresh records on Wall Street thanks to a burst in tech giants including Amazon and Apple.

Tokyo was boosted by a drop in the yen fuelled by minutes from the Fed’s September meeting, where it cut rates by 50 basis points but officials were split on the decision.

They showed that while the move was ultimately supported by 11-1, some “noted that there had been a plausible case for a 25 basis point rate cut at the previous meeting”.

“Some participants observed that they would have preferred a 25 basis point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision,” the minutes said.

Meanwhile, San Francisco Fed President Mary Daly said she had backed the big cut in order to “recalibrate” monetary policy and added that “two more cuts this year, or one more cut this year, really spans the range of what is likely in my mind, given my projection for the economy”.

But she warned the bank would remain “data-dependent”.

Focus now turns to the release of consumer price inflation later in the day and wholesale prices on Friday.

Key figures around 0230 GMT

Shanghai – Composite: UP 0.8 percent at 3,286.30

Hong Kong – Hang Seng Index: UP 2.3 percent at 21,105.19

Tokyo – Nikkei 225: UP 0.3 percent at 39,395.05 (break)

West Texas Intermediate: UP 0.4 percent at $73.55 per barrel

Brent North Sea Crude: UP 0.4 percent at $76.88 per barrel

Dollar/yen: DOWN at 149.16 yen from 149.35 yen on Wednesday

Euro/dollar: UP at $1.0942 from $1.0940

Pound/dollar: UP at $1.3071 from $1.3062

Euro/pound: DOWN at 83.70 pence from 83.72 pence

New York – Dow: UP 1.0 percent at 42,512.00 (close)

London – FTSE 100: UP 0.7 percent at 8,243.74 (close)

You may like

JUST IN: Virgil van Dijk signs new two-year deal with Liverpool

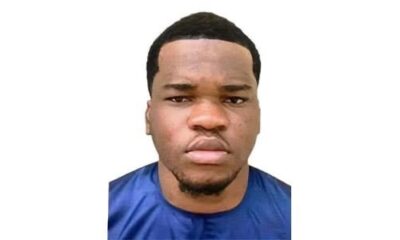

Chimaobi gets four years jail for refusal to accept naira as legal tender

Dollar to Naira exchange rate stands at ₦1,600.80 today

Reject agents of division, exclusion – Fashola to Nigerian youths

Mbah visits Christian Chukwu’s family, pledges to immortalise him

REJOINDER TO STEVE OSUJI’S BILE-FILLED RANT: AN EMBITTERED HACK STRUGGLING TO STAY RELEVANT By Ambrose Nwaogwugwu,

Business

Dollar to Naira exchange rate stands at ₦1,600.80 today

Published

18 minutes agoon

April 17, 2025By

Ekwutos Blog

The exchange rate for the US dollar to the naira today is ₦1,600.7991, marking a slight decline of -0.432% compared to yesterday’s rate.

Over the past week, the dollar has shown relative stability against the naira, although it has slipped by -2.094% compared to its value seven days ago.

Within this one-week window, the exchange rate has fluctuated between a high of ₦1,636.71 recorded on April 10, 2025, and a low of ₦1,589.45 on April 14, 2025. The most significant single-day shift happened on April 10, when the naira strengthened, leading to a -2.252% drop in the dollar’s value.

Current Rates:

1 USD = ₦1,600.7991

1 NGN = $0.00062469

US Dollar to Nigerian Naira Conversion Table:

1 USD = ₦1,600.7991

3 USD = ₦4,802.3973

5 USD = ₦8,003.9955

7 USD = ₦11,205.5937

10 USD = ₦16,007.991

12 USD = ₦19,209.5892

15 USD = ₦24,011.9865

25 USD = ₦40,019.9775

30 USD = ₦48,023.973

45 USD = ₦72,035.9595

50 USD = ₦80,039.955

75 USD = ₦120,059.9325

100 USD = ₦160,079.91

300 USD = ₦480,239.73

400 USD = ₦640,319.64

500 USD = ₦800,399.55

750 USD = ₦1,200,599.325

1,000 USD = ₦1,600,799.1

3,000 USD = ₦4,802,397.3

5,000 USD = ₦8,003,995.5

7,500 USD = ₦12,005,993.25

10,000 USD = ₦16,007,991

15,000 USD = ₦24,011,986.5

25,000 USD = ₦40,019,977.5

50,000 USD = ₦80,039,955

75,000 USD = ₦120,059,932.5

100,000 USD = ₦160,079,910

Nigerian Naira to US Dollar Conversion Table:

1 NGN = $0.00062469

3 NGN = $0.00187406

5 NGN = $0.00312344

7 NGN = $0.00437282

10 NGN = $0.00624688

12 NGN = $0.00749626

15 NGN = $0.00937032

25 NGN = $0.0156172

30 NGN = $0.01874064

45 NGN = $0.02811096

50 NGN = $0.0312344

75 NGN = $0.0468516

100 NGN = $0.0624688

300 NGN = $0.1874064

400 NGN = $0.2498752

500 NGN = $0.312344

750 NGN = $0.46851601

1,000 NGN = $0.62468801

3,000 NGN = $1.87406402

5,000 NGN = $3.12344004

7,500 NGN = $4.68516006

10,000 NGN = $6.24688007

15,000 NGN = $9.37032011

25,000 NGN = $15.61720018

50,000 NGN = $31.23440037

75,000 NGN = $46.85160055

100,000 NGN = $62.46880074

Business

Access Holdings posts N642bn profit after tax, 88% gross earnings growth

Published

3 hours agoon

April 17, 2025By

Ekwutos Blog

Access Holdings Plc says it recorded N642 billion as profit after tax in the full year of 2024, up from the N619.32 billion earned at the end of 2023.

In its audited financial statement for the year ended December 31, 2024, Access Holdings said the figure represents a 3.7 percent increase in profit after tax.

The group said its gross earnings grew by 88 percent year-on-year, rising from N2.594 trillion in 2023 to N4.878 trillion in 2024.

“Profit before tax (PBT) increased by 19% to N867.0 billion, while profit after tax (PAT) rose to N642.2 billion, despite inflationary and macroeconomic challenges.”

According to the statement, the bank’s total assets grew by 55.5 percent to N41.498 trillion and customer deposits rose by 47 percent to N22.525 trillion.

The financial institution said shareholders’ funds also increased by 72 percent, reaching N3.76 trillion.

In terms of economic sustainability, the statement noted that the bank recorded strong strides through its economic, social and governance (ESG) programmes.

“It facilitated $437.42 million in DFI inflows to support MSMEs across Africa, disbursed 1.6 million digital loans to low-income individuals, and booked its first N1.4 billion diaspora mortgage loan,” the statement further reads.

“The Group also achieved a 13.4% reduction in operational emissions, planted 57,302 trees, and enabled solar power adoption for 226 homes and businesses.

“Its headquarters was awarded the IFC EDGE (Excellence in Design for Greater Efficiencies) Green Building Certification for sustainable design and construction standards.”

The statement also noted that the bank posted significant gains across all performance metrics, “with interest income growing by 110% and fees and commissions rising by 81%”.

The organisation said international subsidiaries contributed 48.5 percent to the “banking segment’s PBT, demonstrating strong execution across key markets”.

In 2024, Access Holdings said it also became the first institution to comply with the Central Bank of Nigeria’s recapitalisation directive, raising N351 billion through a rights issue.

The group also said it paid N1.243 billion in penalties to regulatory authorities in 2024 for various infractions

Business

Nigeria, Japan deepen rice production partnership

Published

4 hours agoon

April 17, 2025By

Ekwutos Blog

The Federal Government has reaffirmed its commitment to enhancing food sovereignty and improving the livelihood of smallholder farmers across the country.

The Minister of Budget and Economic Planning, Abubakar Atiku Bagudu, reiterated this during a high-level meeting with the Japan International Cooperation Agency (JICA) Nigeria Office Delegation in Abuja yesterday.

JICA, during the visit, briefed the minister on its project on Capacity Development for enhancement of Rice Seed Production (CaDERSeeP) in Nigeria.

Bagudu noted the significance of Japan’s support for capacity building in rice seed production, which he said aligned with President Bola Ahmed Tinubu’s vision for national food security and economic resilience. He stated that Nigeria’s landholding and rice-farming systems shared similarities with Japan’s, making the collaboration both strategic and culturally relevant.

“We are deeply grateful for Japan’s support. What we are discussing today is not just another agreement — it is a symbol of enduring friendship and shared values,” he said.

He referenced past successes in improving rice yields during his tenure as a governor and vice-chairman of the National Food Security Council, when average yields rose from less than one ton to four tons per hectare in just two cropping seasons.

The minister assured the delegation that the Federal Government would work closely with the Rice Farmers Association of Nigeria (RIFAN) and other stakeholders to ensure the timely and effective implementation of the proposed training programmes on the Foundation Seed (FS) and Certified Seed (CS).

“This cooperation holds the key to reducing poverty and boosting agro-industrial development,” the Minister said.

According to a statement signed by the Director of Information and PR of the ministry, Osagie Jacobs, Bagudu also solicited technical assistance from experts in soil testing to determine what Nigerian soil could best support.

This, he said, was also of significant importance in enhancing agriculture production in Nigeria. He expressed his appreciation to the Government of Japan and the Japan International Cooperation Agency (JICA) for their continued partnership in strengthening Nigeria’s agricultural sector, particularly in rice production.

“This renewed partnership is a significant step forward in Nigeria’s journey towards agricultural transformation, input substitution and sustainable economic growth,” he said.

Speaking earlier, the Chief Representative of JICA, Nigeria Office, Yuzurio Susumu, said the purpose of the visit was to intimate the minister on the aim of the project, which he said, was to strengthen the multiplication and quality control system in the targeted states (Oyo and Niger), the implementation structure, baseline survey, output amongst others.

JUST IN: Virgil van Dijk signs new two-year deal with Liverpool

Chimaobi gets four years jail for refusal to accept naira as legal tender

Dollar to Naira exchange rate stands at ₦1,600.80 today

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.