Business

China’s central bank says opens up $70.6 bn in liquidity to boost market

Published

6 months agoon

By

Ekwutos Blog

China’s central bank boosted support for markets on Thursday as it launched a “swap facility” offering firms access to $70.6 billion in liquidity as Beijing seeks to raise confidence in the country’s flagging economy.

The programme will allow “qualified… companies to exchange bonds, stock ETFs, CSI 300 constituent stocks and other assets with the People’s Bank of China for high-grade liquid assets such as treasury bonds and central bank bills”, the bank said.

“The scale of the first phase of the operation is 500 billion yuan and can be further expanded depending on the situation,” it added.

“Starting today, applications from qualified securities, funds and insurance companies will be accepted.”

Announcing the plans last month, People’s Bank of China chief Pan Gongsheng said the move would “significantly enhance” firms’ ability to access funds to buy stocks.

The world’s second-largest economy has struggled to regain its footing since the lifting of pandemic measures at the end of 2022.

It faces multiple issues including a prolonged debt crisis in the property sector, chronically low consumption and high unemployment among young people.

In response, Beijing last month unveiled its most aggressive stimulus package in years.

The PBoC slashed interest on one-year loans to financial institutions, cut the amount of cash lenders must keep on hand and pushed to lower rates on existing mortgages.

Several major cities — including Shanghai, Guangzhou and Shenzhen — have also further eased restrictions on buying homes, and top officials including Premier Li Qiang have called for more effective implementation of the slate of measures.

The announcements triggered a blistering rally on stock markets on the mainland and in Hong Kong.

However, investor sentiment cooled after a news conference Tuesday by the country’s top economic planning agency that failed to unveil any more stimulus or provide details on the measures already announced.

Zheng Shanjie, head of the National Development and Reform Commission, said only that Beijing was “fully confident in achieving the goals of economic and societal development for the year”.

He added that “we are also fully confident in maintaining stable, healthy and sustainable development”.

Analysts have warned that more direct state support is needed to boost consumption and achieve the government’s official national growth target of about five percent for this year.

More may be in the offing on Saturday, when finance minister Lan Fo’an is set to hold a briefing on fiscal policy in Beijing.

Authorities said Wednesday that Lan will outline “countercyclical adjustment of fiscal policy to promote high-quality economic development”.

You may like

500K deposit: Man who lost his pregnant wife responds after Reuben Abati, blasted him.

Kano deputy gov reports back after peace-building mission in Edo

Despite criticism, Ibas swears in sole administrators for Rivers LGAs

Kano lawyer petitions Tinubu over ‘politically motivated’ police invitation of Emir Sanusi

U.S withdraws military aid from Niger, redirects to Côte d’Ivoire, Benin, Ghana

FCT Minister rolls out major land administration reforms, introduces strict timelines for allottees

Business

AFDB REAFFIRMS $2.2 BILLION PLEDGE AS VP SHETTIMA COMMISSIONS 2ND SAPZ IN CROSS RIVER ** Says agro-industrial processing zones will empower farmers, attract investors, diversify Nigeria’s economy

Published

1 day agoon

April 10, 2025By

Ekwutos Blog

STATE HOUSE PRESS RELEASE

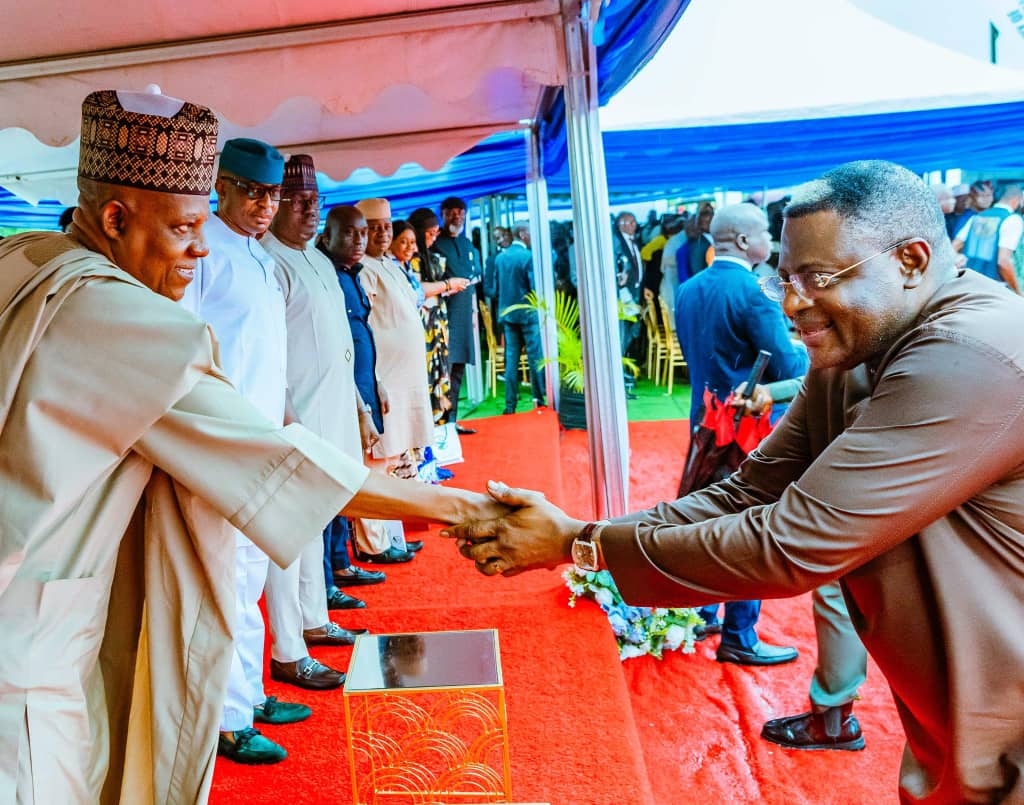

AFDB REAFFIRMS $2.2 BILLION PLEDGE AS VP SHETTIMA COMMISSIONS 2ND SAPZ IN CROSS RIVER

** Says agro-industrial processing zones will empower farmers, attract investors, diversify Nigeria’s economy

The federal government has commenced construction of the Special Agro-Industrial Processing Zone in Calabar, Cross River State, as part of a nationwide drive to transform the agricultural sector and stimulate inclusive economic growth across Nigeria.

This is the second of such a facility initiated within 72 hours after Vice President Kashim Shettima had on Tuesday performed the groundbreaking ceremony for the construction of the Kaduna State SAPZ in the Chikun local government area of the state.

Already, the AfDB_Group has reaffirmed its commitment to mobilising an additional $2.2 billion to execute the second phase of the SAPZ project across 28 states in Nigeria.

Speaking on Thursday when he performed the groundbreaking ceremony of SAPZ in Calabar, the Vice President described the project as “a game changer” that aligns with the President Tinubu administration’s Renewed Hope Agenda, aimed at diversifying the nation’s economy, addressing food security, tackling rural unemployment, as well as empowering farmers and the youth population.

“There is no intervention more practical in our dream of a nation where the potential of agriculture is maximised than what’s brought us together today. This isn’t just a project—it’s a bold vision to transform Nigeria’s agricultural value chain,” VP Shettima said.

According to him, the SAPZ initiative, supported with counterpart funding from development partners and the private sector, is designed to address challenges that have long hindered the growth of Nigeria’s agricultural economy, including inadequate processing infrastructure, limited access to markets, and rural unemployment.

“For far too long, our farmers have contended with poor infrastructure, lack of access to finance, and inadequate processing facilities. This zone is designed to confront those challenges head-on by creating an ecosystem where innovation, investment, and collaboration thrive,” he noted.

VP Shettima explained that the Calabar SAPZ will serve as a hub for agro-processing and storage, providing farmers and agripreneurs with critical infrastructure to scale their operations and tap into local and international markets.

“This is where farmers will meet with private investors, where ideas will turn into enterprise, and where our youth will find meaningful opportunities,” he said, disclosing that the Tinubu administration has classified SAPZ as a priority program in Nigeria’s quest for food security, with plans to institutionalize it as a government agency that will facilitate agricultural industrialization across all 36 states.

“These zones will generate thousands of jobs. They will create opportunities for young people, empower them with skills and knowledge to engage in meaningful work and help them contribute positively to the economy. Cross Riverians, development has come to your doorstep. For you and for the country, SAPZ is a game changer—one that will enable Nigeria to diversify its economy with a sustainable source.,” he stated.

Senator Shettima also expressed gratitude to key international development partners, including the African Development Bank, the Islamic Development Bank, and the International Fund for Agricultural Development, for their support and belief in Nigeria’s vision.

The Vice President commended Cross River State Governor, Senator Prince Bassey Edet Otu, for his collaboration, describing him as “a critical foundation for the success of this intervention and a great ally in development.”

Earlier, Cross River State Governor, Senator Otu, said the programme marked a watershed in the ongoing bid by his administration to establish the renewable resource base of the state through the full utilisation of agriculture and its multiple value chain.

Otu pointed out that in Cross River State, the establishment of a cluster of smallholder farmers in cash crops such as rice, cassava, millet, and cocoa across the state is the right step towards the agro-industrial revolution.

He said the paradigm shift from a non-renewable to a renewable resource base also holds the key to the prosperity of many nations, hence the imperative to join the league of sub-nationals in Nigeria that have adopted agriculture as the mainstay of their economy.

“The deliverables of the envisaged projects are food security, diversification of the state economy towards export-oriented trajectory and increase in the State’s GDP. When these projects are fully operational there is an expected robust collaboration with reputable agro-based processing institutes, universities and the rest, aimed at accelerating breakthroughs in many agro-industrial production.”

Also, Minister of Agriculture and Food Security, Senator Abubakar Kyari, said the programme would transform the agricultural production and agro-investment landscape in Nigeria under the Renewed Hope Agenda of President Tinubu.

Kyari thanked Vice President Shettima for his leadership and political backing at the highest level in the implementation of the SAPZ in Nigeria, just as he also commended the Governor of Cross River State for his commitment to ensuring that the state is among the front-running states that will commence the construction of their Agro-Industrial Processing Hub.

In his remark, President of AfDB, Dr Akinwumi Adesina, reiterated the bank’s pledge to mobilise $2.2 billion to execute the SAPZ project in 28 states across Nigeria.

Adesina observed that Cross River State has a significant role to play in Nigeria’s agricultural transformation because of the vast production of cocoa, cassava, rice and banana in the state, saying Obudu Cattle Ranch alone can turn the state into a huge livestock producer.

He also acknowledged that the state is ideal for SAPZ because it has an export processing zone, ports facility, and export handling capabilities, adding that the SAPZ in Calabar can easily be linked to the seaport for the transportation of processed agricultural commodities to the export market in neighbouring countries, including Cameroon and the rest.

“The African Development Bank, as you know, is spearheading this together with our partners, which include the Islamic Development Bank and the International Fund for Agricultural Development, and we have put together $934 million from the African Development Bank, with core financing of $938 million from these partners.

“The first phase of SAPZ in Nigeria will be in eight states of Cross River, Kaduna, Kano, Katsina, Oyo, Ogun, Kwara, Imo and the Federal Capital Territory. We are delighted with our partnership with the Islamic Development Bank and the International Fund for Agricultural Development.

“We have put together a financing package of $510 million to make this work. We expect, in the second phase of this, to mobilise $2.2 billion to be able to work for 28 states across the federation with several partners,” the AfDB President said.

Stanley Nkwocha

Senior Special Assistant to The President on Media & Communications

(Office of The Vice President)

10th April, 2025

Business

Tariff war could reduce US-China goods trade by 80% – WTO DG, Okonjo-Iweala

Published

2 days agoon

April 10, 2025By

Ekwutos Blog

The Director-General of the World Trade Organization, Ngozi Okonjo-Iweala has said the US-China tariff war could cut trade in goods between the two economic giants by 80 percent, pulling down the rest of the world economy.

Okonjo-Iweala said this in a statement on Wednesday.

Ekwutosblog reports that US President Donald Trump raised tariffs on China to 125 percent on Wednesday as the world’s two largest economies fought over retaliatory levies.

“The escalating trade tensions between the United States and China pose a significant risk of a sharp contraction in bilateral trade. Our preliminary projections suggest that merchandise trade between these two economies could decrease by as much as 80 percent,” she said.

According to her, the United States and China together accounted for three per cent of world trade and warned that the conflict could severely damage the global economic outlook.

Trump, even as he slapped further tariffs on China, paused higher tariffs on the rest of the world for 90 days after dozens of countries reached out for negotiations.

Okonjo-Iweala warned that the world economy risked breaking into two blocs, one centred around the United States and the other China.

“Of particular concern is the potential fragmentation of global trade along geopolitical lines. A division of the global economy into two blocs could lead to a long-term reduction in global real GDP by nearly seven percent,” she said.

She, therefore, urged all WTO members to address the challenge through cooperation and dialogue.

A few hours earlier, the US president ramped up duties on Chinese goods to 104 percent, only to hike them further when China retaliated by raising tariffs on US imports to 84 percent.

Trump, in a social media post announcing the moves, said China had been singled out for special treatment because of the lack of respect that China has shown to the World’s Markets.

Business

FCCPC Urges Nigerians to Report Harassing Loan Apps and Businesses

Published

5 days agoon

April 7, 2025By

Ekwutos Blog

The Federal Competition and Consumer Protection Commission (FCCPC) is advising Nigerians to report any loan apps or businesses that engage in harassing behavior over unpaid loans.

According to the FCCPC, no consumer should live in fear of harassment or intimidation.

Ekwutosblog gathered that Consumers can file complaints with the FCCPC through their website or contact their customer service hotline.

The FCCPC is responsible for protecting consumer rights and promoting fair competition in Nigeria.

FCCPC has taken steps to regulate digital money lenders and enforce consumer protection laws, including fining Meta and WhatsApp $220 million for violating the Federal Competition and Consumer Protection Act (FCCPA) and the Nigeria Data Protection Regulation (NDPR)

To file a complaint, follow these steps

Visit the FCCPC website and fill out the complaint form. Provide detailed information about the harassment, including dates, times, and communication records. Submit supporting documents, such as screenshots or messages. FCCPC Website: https://fccpc.gov.ng/ Customer Service Hotline: 0805 600 2020, 0805 600 3030

Email: mailto:contact@fccpc.gov.ng

500K deposit: Man who lost his pregnant wife responds after Reuben Abati, blasted him.

Kano deputy gov reports back after peace-building mission in Edo

Despite criticism, Ibas swears in sole administrators for Rivers LGAs

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.