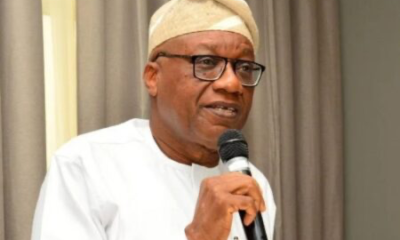

Chief Vincent was Born in Neni, Anambra State, He spent his early life in his hometown after which he moved to Kano state where He learnt how to fix punctured tyres (vulcanizer), and became perfect at it (a time when few people could do it), because of it he had a lot of customers queuing for his vulcanizing services.

He did the job for more few years before he decided to go into the transportation business as a bus conductor. He continued the bus conductor job until 1972 when he had gathered enough money to buy his bus. After acquiring maximum knowledge on how the transportation business works, he then decided to stop working as a bus conductor and he acquired a mini-bus to ply the Enugu to Onitsha route.

In 1973 he relocated his business operations from Onitsha to Lagos and ventured into a more developed transport business, which he started with two locally built Mercedes Benz 911 buses. After seven years of operating in Lagos, the number of buses he owned increased from 2 to 40 alongside his transport business. He also engaged in the delivery of goods which also boosted the success of his business.

His exceptional customer service delivery got many people to patronize his business and by 1978, he decided to expand by opening up a new interstate route, plying from Lagos to Onitsha to Owerri. He also bought a Mercedes Benz 0362 luxury bus for this purpose. This expansion gained his business more fame and within 6 years, his number of buses grew to 150. Owing to the success of the business, Chief Vincent Incorporated his business in 1984 so he could fully cover every possible part of Nigeria, as a leading inter-state luxury bus company.

Today, The Young Shall Grow Motors is one of the largest luxury bus companies in Nigeria with over 500 buses that ply almost every route in Nigeria as well as other west African countries like Ghana, Burkina Faso, Mali and The Benin Republic.

He also has businesses in the Hospitality, Oil and Gas, Real estate sectors.

From Vulcanizer to millionaire in dollars, today his net worth is over 300 million dollars.

Trending6 months ago

Trending6 months ago

Politics6 months ago

Politics6 months ago

Politics6 months ago

Politics6 months ago

Politics6 months ago

Politics6 months ago