Business

Edo Refinery Struggles with Crude Shortage, Calls for NNPC to Fulfill Supply Agreements

Published

8 months agoon

By

Ekwutos Blog

Edo Refinery has raised alarm over crude supply issues despite agreements with NNPC, operating below capacity due to persistent shortages.

The management of AIPCC Energy Limited, operators of the Edo Refinery and Petrochemicals Company Limited (ERPCL), on Sunday raised the alarm over the persistent lack of crude despite being a full functional 1,000 barrels per day stream crude oil refinery.

It said in spite of the disclosure by the Dangote Refinery on the refusal of the Nigerian National Petroleum Company Limited (NNPC) and the directive by President Bola Tinubu that the company should supply crude oil to Dangote Refinery and other Modular Refineries in the country in Naira denomination, the Edo Refinery was yet to get any from the relevant authorities.

Speaking to journalists in Benin-City at the weekend, the management of Edo Refinery situated at Ologbo in Ikpoba-Okha local government area of Edo State, said it was facing significant challenges due to persistent lack of crude oil supply.

Representative of the company, Segun Okeni, who spoke at the event, said the refinery, which requires 1,000 bpd stream crude can barely function at full installed capacity.

Okeni said though the company has had existing crude oil supply agreements with Seplat and ND Western since 2022, bureaucratic bottlenecks had prevented the refinery from accessing the much-needed resource.

He alleged that in 2021, ERPCL’s addressed a letter to the Group Chief Executive Officer of NNPC, Mele Kyari, after a series of meetings and constant communication with him did not hear much fruit.

“On August 18, 2021, our team led by our chairman, met with the NNPC GCEO and its top management team to discuss our intention to buy crude oil from NNPC and we immediately wrote seeking crude supply.

“In July 2022, the representatives of NNPC visited our facility for site inspection and to confirm the mechanical completion of the Edo refinery. In September 2022, we were invited for a commercial negotiation meeting with the NNPC head of terms, after which we sent a follow-up letter identifying the oil fields from which we can offtake crude oil.

“In March 2022, we also wrote to the Ministry of Petroleum Resources, informing it of our refinery status, future projects and our challenges of lack of crude oil supply to our refinery.

“We had also written and had a meeting with the NNPC Exploration and Production Limited (NEPL) between November 2022 and March 2023, indicating our severe need for crude oil supply from oil fields where NEPL has equity stakes,” he stated.

The ERPCL representative however, noted that despite the meetings, correspondences and communications with NNPC over the past three years on the issues of crude oil supply, nothing was done.

Besides, he identified other key issues encountered by the refinery as the inability of NNPC to assign any of the preferred fields to allocate crude to the company since it started having engagement with the management August 18, 2021.

He pointed out that even with the options given to allocate crude to the refinery from ND Western, First Hydrocarbon, and Seplat, nothing happened till date.

“ERPCL also has a Crude Oil Supply Agreement with ND Western to lift crude oil from the Ughelli Pumping Station (UPS) owned by NEPL and operated by Shoreline.

“We have held several meetings with Shoreline and Heritage Oil and indicated our readiness to make modifications needed to offtake crude oil from the UPS but no progress has been made till date,” the company added.

On the way forward, ERPCL said NNPC and other producers need to put loading infrastructure in place to allow for truck loading, decrying why Dangote would be getting 30,000 bpd because it opened up to the public, while smaller refineries are not being served which he likened to lack of respect for small people who can also grow the economy alongside the big players.

The representative of ERPCL therefore sought Kyari’s intervention as group GCEO of NNPC a d implement the Seplat-ERPCL agreement to enable Edo refinery to start lifting crude oil from Oil Mining License (OML).

Describing the past two years as frustrating for the establishment, he said: “If we local investors can’t get crude even as small as we are, how can foreign investors be encourage to invest in the country.

“The total daily demand of all modular refineries is not up to 2 per cent of the daily crude oil production. Our lifting from the pumping station, will even reduce pipe line losses,” he added.

Okeni argued that the advantage of loading from NNPC pumping stations to the expert terminal was that it costs less because the cost of pipeline export terminal charges and loss will be saved.

According to him, this will make the modular refineries more competitive than the offshore refineries who come to the export terminal to take the crude, thereby making cost savings to trickle down to Nigerian consumers.

“If the smallest refinery is not getting crude, it will discourage investors in that area” Okeni said, contending that because of lack of crude, OPAC Refinery operates less than 3 per cent of its installed capacity and Edo Refinery less than 10 per cent of installed capacity.

He noted that Nigeria loses millions of dollars following the inability of NNPC to supply modular refineries over the past three years which has a total installed capacity of less than 30,000bpd.

You may like

Trump tariffs: 50 nations seek new US trade talks — official

Peter Obi Is weak and Spineless , That’s why he couldn’t field any candidate for the November Anambra Election – Noble Eyisi (Former Unizik President

Plateau killings barbaric – CAN demands justice for victims

Rights group condemns killings in Plateau, calls for govt intervention

I’m coming for you – Congressman vows to begin Trump’s impeachment

‘I have played godfather, now I want to be father’ — Ukachukwu declares as he clinches APC Anambra ticket

Business

Dangote refinery, NNPC: More fuel stations increase pump price in Nigeria

Published

2 days agoon

April 4, 2025By

Ekwutos Blog

The price of Premium Motor Spirit, popularly known as fuel, has recorded a significant increase in the past days, which may worsen the economic hardship Nigerians face.

MRS, a filling station partner of Dangote Refinery, kicked off the latest fuel price increase when it adjusted its petrol pump to between N925 and N950 per litre in Lagos and the Federal Capital Territory, Abuja.

Similarly, other fuel marketers such as Empire Energy, Recoil, Juda Oil, Total, Emedab, and others also increased their fuel pump to between N950 and N970 per litre.

On Wednesday, the Nigerian National Petroleum Company Limited retail outlets also jacked up their fuel price to N950 per litre from N880 in Abuja.

Summarily, Ekwutosblog observed motorists will have to pay N70 more to buy a litre of petrol in the coming days.

The development comes amid the suspension of petrol product sales in Naira by Dangote Refinery. This follows the initiation of the naira-for-crude sale deal between Dangote Refinery and the federal government through NNPCL.

On Wednesday, President Bola Ahmed Tinubu announced a reshuffling of NNPCL.

Meanwhile, local oil prices are increasing in Nigeria, despite the decline in global crude prices. As of the time of this report, United States West Texas Intermediate was at $62.15 per barrel, down from above $65, while Brent crude stood at $65.42 per barrel, down from $72 last week.

Business

Global Billionaires’ Net Worth Plummets by $65 Billion Amid Market Downturn

Published

3 days agoon

April 4, 2025By

Ekwutos Blog

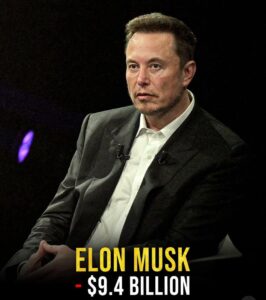

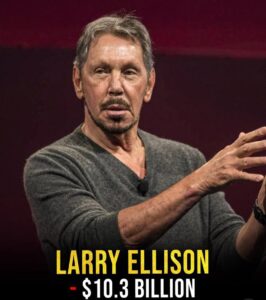

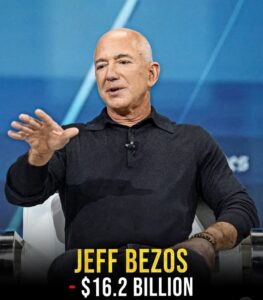

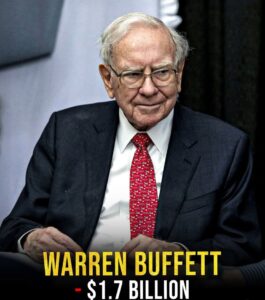

In a significant setback, the world’s wealthiest individuals collectively lost over $65 billion in net worth today, as key market sectors experienced a sharp downturn.

This decline affected prominent figures in technology, finance, and other industries, sending shockwaves through financial markets.

Ekwutosblog reports that the downturn occurs amidst cautious optimism that new US policies may not be as severe as initially feared.

However, the immediate impact has already been felt, leading to a decline in the net worth of billionaires such as Elon Musk, Warren Buffett, and Jeff Bezos, amongst others who have significant stakes in tech, finance, and other industries.

The global billionaire population has been growing, with over 2,850 individuals representing almost $15 trillion in wealth.

Despite this growth, the market downturn serves as a reminder of the volatility and risks associated with wealth concentration.

Business

Sterling Bank Makes History: Scraps Transfer Fees for Local Online Transactions, Earns Praise from Lawmakers, Including Mohammed Bello El-Rufai, and the Public

Published

3 days agoon

April 3, 2025By

Ekwutos Blog

Sterling Bank has taken a groundbreaking step to ease the financial burden on Nigerians by eliminating transfer fees and other charges for local online transactions.

This move is a significant stride towards financial inclusion and customer-centric banking, particularly during a time when economic pressures are high.

Ekwutosblog gathered that this initiative has been commended by Mohammed Bello El-Rufai, Chairman of the House Committee on Banking Regulations, who praised Sterling Bank’s commitment to creating a more accessible and equitable banking system.

El-Rufai encouraged other financial institutions to follow Sterling Bank’s example, emphasizing that a competitive banking sector prioritizing Nigerians’ interests will strengthen the economy and rebuild public trust in financial services.

Sterling Bank’s decision to scrap transfer fees is expected to benefit individuals and small business owners who frequently make online transactions. The bank’s customers can now perform local transfers via the mobile app without incurring any charges. Obinna Ukachukwu, Growth Executive at Sterling Bank, stated that access to one’s own money shouldn’t come with a penalty, highlighting the bank’s values-driven approach to customer-centric banking.

This move has sparked widespread public approval, with many calling on other banks to adopt similar policies.

As policymakers, El-Rufai reiterated their commitment to fostering a regulatory environment that encourages pro-customer initiatives while ensuring sustainability within the banking sector.

Trump tariffs: 50 nations seek new US trade talks — official

Peter Obi Is weak and Spineless , That’s why he couldn’t field any candidate for the November Anambra Election – Noble Eyisi (Former Unizik President

Plateau killings barbaric – CAN demands justice for victims

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.