Business

Nigeria spends $25 billion on petrol importation yearly – VP Shettima

Published

11 months agoon

By

Ekwutos Blog

Vice-President Kashim Shettima has revealed that Nigeria spends $25 billion per annum on the importation of petroleum products.

He said this while speaking at an event in Victoria Island, Lagos on Thursday, May 23.

According to him, “With the support our government is lending to our private sector-led oil refineries and rejuvenation of some of the state-owned facilities.

The $25 billion we spend yearly importing petroleum and other refined products will soon be a thing of the past allowing the naira a much-deserved breath.”

Shettima said the country will not hesitate to backtrack and review policies if it would impose undue hardship on Nigerians as it “has been seen over time”.

“So this administration is not out to make the life of Nigerians tougher, but to make the Nigerian economy sustainable, and the lives of our people more enjoyable.

Rest assured, ladies and gentlemen, that the next few years will be full of positive achievements. They include improvements in the standards of living, higher productivity, food security, bumper harvests and remarkable achievement with the guidance and grace of Almighty God,” he said.

You may like

REJOINDER TO STEVE OSUJI’S BILE-FILLED RANT: AN EMBITTERED HACK STRUGGLING TO STAY RELEVANT By Ambrose Nwaogwugwu,

Access Holdings posts N642bn profit after tax, 88% gross earnings growth

Nigeria, Japan deepen rice production partnership

Declare state of emergency on your presidency, Nigeria collapsing – Atiku tells Tinubu

Nigeria, South Africa strengthen energy ties to curb continental energy deficit

When the Time Comes, We’ll Handle Wike… Azikwe used to say Surulere” — Ex-Governor Ada-George Drops Bombshell, Channels Azikiwe’s Spirit Amid Rivers Crisis

Business

Access Holdings posts N642bn profit after tax, 88% gross earnings growth

Published

3 hours agoon

April 17, 2025By

Ekwutos Blog

Access Holdings Plc says it recorded N642 billion as profit after tax in the full year of 2024, up from the N619.32 billion earned at the end of 2023.

In its audited financial statement for the year ended December 31, 2024, Access Holdings said the figure represents a 3.7 percent increase in profit after tax.

The group said its gross earnings grew by 88 percent year-on-year, rising from N2.594 trillion in 2023 to N4.878 trillion in 2024.

“Profit before tax (PBT) increased by 19% to N867.0 billion, while profit after tax (PAT) rose to N642.2 billion, despite inflationary and macroeconomic challenges.”

According to the statement, the bank’s total assets grew by 55.5 percent to N41.498 trillion and customer deposits rose by 47 percent to N22.525 trillion.

The financial institution said shareholders’ funds also increased by 72 percent, reaching N3.76 trillion.

In terms of economic sustainability, the statement noted that the bank recorded strong strides through its economic, social and governance (ESG) programmes.

“It facilitated $437.42 million in DFI inflows to support MSMEs across Africa, disbursed 1.6 million digital loans to low-income individuals, and booked its first N1.4 billion diaspora mortgage loan,” the statement further reads.

“The Group also achieved a 13.4% reduction in operational emissions, planted 57,302 trees, and enabled solar power adoption for 226 homes and businesses.

“Its headquarters was awarded the IFC EDGE (Excellence in Design for Greater Efficiencies) Green Building Certification for sustainable design and construction standards.”

The statement also noted that the bank posted significant gains across all performance metrics, “with interest income growing by 110% and fees and commissions rising by 81%”.

The organisation said international subsidiaries contributed 48.5 percent to the “banking segment’s PBT, demonstrating strong execution across key markets”.

In 2024, Access Holdings said it also became the first institution to comply with the Central Bank of Nigeria’s recapitalisation directive, raising N351 billion through a rights issue.

The group also said it paid N1.243 billion in penalties to regulatory authorities in 2024 for various infractions

Business

Nigeria, Japan deepen rice production partnership

Published

3 hours agoon

April 17, 2025By

Ekwutos Blog

The Federal Government has reaffirmed its commitment to enhancing food sovereignty and improving the livelihood of smallholder farmers across the country.

The Minister of Budget and Economic Planning, Abubakar Atiku Bagudu, reiterated this during a high-level meeting with the Japan International Cooperation Agency (JICA) Nigeria Office Delegation in Abuja yesterday.

JICA, during the visit, briefed the minister on its project on Capacity Development for enhancement of Rice Seed Production (CaDERSeeP) in Nigeria.

Bagudu noted the significance of Japan’s support for capacity building in rice seed production, which he said aligned with President Bola Ahmed Tinubu’s vision for national food security and economic resilience. He stated that Nigeria’s landholding and rice-farming systems shared similarities with Japan’s, making the collaboration both strategic and culturally relevant.

“We are deeply grateful for Japan’s support. What we are discussing today is not just another agreement — it is a symbol of enduring friendship and shared values,” he said.

He referenced past successes in improving rice yields during his tenure as a governor and vice-chairman of the National Food Security Council, when average yields rose from less than one ton to four tons per hectare in just two cropping seasons.

The minister assured the delegation that the Federal Government would work closely with the Rice Farmers Association of Nigeria (RIFAN) and other stakeholders to ensure the timely and effective implementation of the proposed training programmes on the Foundation Seed (FS) and Certified Seed (CS).

“This cooperation holds the key to reducing poverty and boosting agro-industrial development,” the Minister said.

According to a statement signed by the Director of Information and PR of the ministry, Osagie Jacobs, Bagudu also solicited technical assistance from experts in soil testing to determine what Nigerian soil could best support.

This, he said, was also of significant importance in enhancing agriculture production in Nigeria. He expressed his appreciation to the Government of Japan and the Japan International Cooperation Agency (JICA) for their continued partnership in strengthening Nigeria’s agricultural sector, particularly in rice production.

“This renewed partnership is a significant step forward in Nigeria’s journey towards agricultural transformation, input substitution and sustainable economic growth,” he said.

Speaking earlier, the Chief Representative of JICA, Nigeria Office, Yuzurio Susumu, said the purpose of the visit was to intimate the minister on the aim of the project, which he said, was to strengthen the multiplication and quality control system in the targeted states (Oyo and Niger), the implementation structure, baseline survey, output amongst others.

Business

Sustaining monetary, fiscal policies for bank recapitalisation

Published

7 hours agoon

April 17, 2025By

Ekwutos Blog

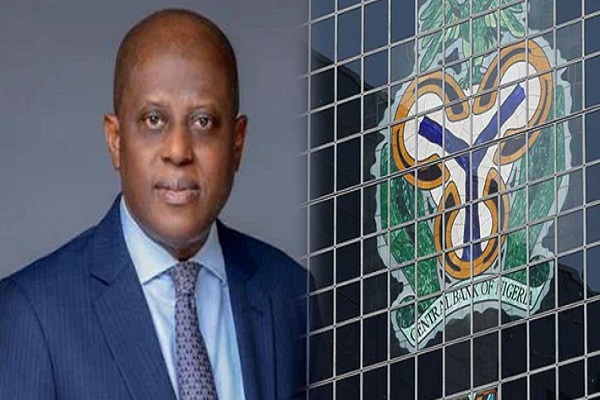

The emergence of stronger and bigger banks is one of the crucial benefits expected from the ongoing Central Bank of Nigeria (CBN)-led recapitalisation of banks. The apex bank believes that achieving sustainable economic growth requires strong support from the financial system. The financial sector regulator is, therefore, keen on aligning monetary and fiscal policies to achieve government’s vision of growth for businesses and $1 trillion economy size for the country, writes Assistant Editor, COLLINS NWEZE.

Aligning fiscal and monetary policy objectives comes with great benefits to the economy. The Central Bank of Nigeria (CBN) is at the centre of achieving fiscal and monetary policies collaboration and supporting the government’s plan for $1 trillion economy size.

For a government that wants to grow its economy to $1 trillion mark, the support of the financial services sector led by the Central Bank of Nigeria (CBN) Governor, Olayemi Cardoso is crucial.

The CBN boss had explained that bank recapitalisation ensures that lenders are well-capitalised, enabling them to take on greater risks, particularly in underserved markets. With stronger capital bases, banks can provide more loans and financial products to Micro Small and Medium Enterprises (MSMEs), rural communities and other vulnerable segments that have previously struggled to access formal financial services.

The CBN had, on March 28, 2024 announced a two-year bank recapitalisation exercise which commenced on April 1, 2024 and is expected to end on March 31, 2026.

The recapitalisation plan requires minimum capital of N500 billion, N200 billion and N50 billion for commercial banks with international, national and regional licenses respectively.

Others included merchant banks N50 billion; non-interest banks with national license N20 billion and non-interest banks with regional license will now have N10 billion minimum capital. The 24-month timeline for compliance ends on March 31, 2026.

Cardoso said the recapitalisation policy not only strengthens financial stability but also serves as a catalyst for inclusive growth.

“By enabling banks to extend more credit to MSMEs, we enhance job creation and productivity. Furthermore, with increased capital, banks can invest in technology and innovation, crucial for driving digital financial services such as mobile money and agent banking. These technologies are important to breaking down geographic and economic barriers, bringing financial services to even the most remote areas,” he stated.

He said Nigeria has what it takes to deepen financial inclusion and support the growth of business and economy. He said the recapitalisation exercise will also support the government’s efforts to achieve a $1 trillion economy.

The CBN further underscored the importance of banking recapitalisation as a major catalyst for the achievement of the $1 trillion economy agenda of the government.

Banking sector remains robust

Cardoso explained that the banking sector remains robust, with key indicators reflecting a resilient system.

“The non-performing loan ratio remains within the prudential benchmark of five per cent, showcasing strong credit risk management. The banking sector liquidity ratio comfortably exceeds the regulatory floor of 30 per cent, a level which ensures banks are maintaining adequate cash flow to meet the needs of customers and their operations. The recent stress test conducted also reaffirmed the continued strength of our banking system,” he said.

“I am pleased to note that a significant number of banks have raised the required capital through rights issues and public offerings well ahead of the 2026 deadline. I believe that the banking sector is in a strong position to support Nigeria’s economic recovery by enabling access to credit for MSMES and supporting investment in critical sectors of our economy,” he said.

The CBN Deputy Governor, Corporate Services, Ms. Emem Usoro, said the journey to a $1 trillion economy requires structured planning, clearly defined policies, unwavering implementation, and an inclusive approach that aligns public and private sector interests.

At the just-concluded seminar organised by the CBN for business editors and financial correspondents in Abuja, Usoro said that one of the key components of the $1 trillion ambition is the recapitalisation of Nigerian banks.

She noted that banks must be sufficiently capitalised to meet the financial demands of a larger and more dynamic economy.

“As we work towards building a $1 trillion dollar economy, we must consider the recapitalisation of our banks to be able to fund, finance and power the economy, and to favourably compete globally,” Usoro said.

She further called for a collective effort from all stakeholders, adding that the financial system must be prepared to play its role in powering development.

“We should particularly pay attention to bank recapitalisation to ensure that our banks are strong, resilient and stable enough to carry out financial intermediation, and the much-needed financing of development projects and programmes,” Usoro said.

The Group Managing Director of United Bank for Africa (UBA), Mr. Oliver Alawuba described the ongoing CBN bank recapitalisation policy as both timely and essential in positioning the financial system to meet the demands of a growing and globally competitive economy.

According to Alawuba, the initiative is expected to boost the resilience of the banking sector by strengthening its capacity to withstand economic shocks such as inflation, currency volatility and global geopolitical disruptions. He noted that the policy will also place Nigerian banks on a stronger footing to finance the country’s long-term economic transformation, including funding of large-scale infrastructure and industrial projects.

Alawuba further stressed that the recapitalisation policy goes beyond regulatory compliance. It is a forward-looking strategy aimed at equipping Nigerian banks to operate at the scale and sophistication required by a trillion-dollar economy. He said the move would enhance the sector’s ability to support traditional economic drivers such as oil and gas, agriculture and manufacturing, as well as emerging sectors such as fintech, green energy and infrastructure development.

“Nigerian banks need adequate capital buffers to meet the evolving demands of these sectors. Without this, the industry cannot effectively rise to the challenge,” he said.

Alawuba further pointed out the sharp contrast between Nigerian banks and their counterparts in more advanced economies, where bank assets typically range between 70 and 150 per cent of Gross Domestic Product (GDP). In Nigeria, bank assets accounted for just 11.97 per cent of GDP as of 2024, a gap he said must be addressed if the country’s financial system is to align with international standards.

He commended the CBN’s recent directive mandating a significant increase in minimum capital thresholds, describing it as recognition of the urgent need for stronger financial institutions capable of delivering on national priorities such as infrastructure expansion, digital transformation, inclusive financial services and economic diversification.

Alawuba concluded that a robust, well-capitalised banking sector is critical for Nigeria’s aspiration to become a one trillion-dollar economy, and the recapitalisation drive is a forward-looking step to achieve that goal.

According to the Director of the Banking Supervision Department at the CBN, Olubuka Akinwunmi provided insights into the state of the banking sector by stating that banks have so far remained within the prudential thresholds stipulated by the regulator, including benchmarks for capital adequacy ratio and non-performing loans.

“Currently, all our banks are still within the prudential thresholds that were set. And they are actively pursuing various recapitalisation efforts,” Akinwunmi said.

He said priority sectors such as agriculture, infrastructure and manufacturing are receiving attention from both the government and financial institutions, as they are crucial to achieving a trillion-dollar economy.

“This year’s national budget reflects a clear emphasis on critical sectors such as health, education, infrastructure and agriculture. Banks are taking cues from these priorities, recognising them as viable areas for business expansion,” Akinwunmi said.

On how many internationally-active banks had met the new N500 billion capital requirement, he noted that substantial progress has already been made.

“We are halfway through the journey in terms of timeline, and in terms of capital already raised; we are also halfway through. That is a positive signal,” he said.

He added that the decision to start the recapitalisation process early has helped insulate the financial system from emerging global and domestic shocks.

“The emerging global economic shifts and pressures were not lost on the management of the CBN. We started early. If we had waited till now, the challenges would have been greater. But we acted in time,” he stated.

Dr Akinwunmi expressed his confidence that the recapitalisation requirements will be met, stressing that existing shareholders’ funds continue to serve as a buffer. However, the CBN deliberately opted for fresh capital inflows, particularly from foreign investors who have shown renewed confidence in Nigeria’s financial system.

“International perception of Nigeria’s banking sector is improving. The reforms over the past year, especially around the foreign exchange regime and improved transparency regarding reserves, have improved investors’ confidence,” he said.

He cited recent disclosures on Nigeria’s net reserves and improvements in regulatory credibility as key factors that are reshaping the outlook for foreign direct investment in the banking sector.

On the Loan to Deposit Ratio (LDR), Akinwunmi explained that the current 50 per cent benchmark does not reflect a reluctance to lend but rather a contextual response to inflation and other macroeconomic challenges.

“As the macro-economic environment stabilises, banks will naturally increase lending. It’s a cautious approach to ensure that lending supports sustainable growth,” he said.

He also touched on the Cash Reserve Ratio (CRR), stating that there has been marked improvement in transparency. Banks now have a clearer understanding of CRR computations, unlike in the past, which enhances predictability and compliance.

On Small and Medium Enterprises (SME) funding, he confirmed that banks have continued to make provisions, but the CBN remains actively engaged to ensure proper disbursement and sectorial targeting. Supervisory oversight, he explained, is being deployed to verify compliance and effectiveness of disbursed funds.

On incentives, he said the most powerful incentive for banks lay in the opportunities provided by a growing economy.

“A stronger bank can take on big-ticket businesses, including infrastructure financing. The current reforms, such as the infrastructure concession plans, present viable business opportunities for well-capitalised banks,” Akinwunmi said.

The capital verification process, according to him, is thorough and designed to ensure that only legitimate, unborrowed funds are used for recapitalisation. An industry-wide tracking mechanism has been established to streamline verification across institutions and enhance collaboration.

“Our examiners follow each capital trail meticulously, moving from one bank to another as necessary. Even if it’s not your bank under verification at that moment, we expect full cooperation to trace the sources of capital,” he said.

On the broader question of resilience to global shocks, he maintained that Nigerian banks are being positioned to remain attractive to investors and capable of withstanding external disruptions.

“CBN is monitoring developments closely and adjusting where necessary. The recapitalisation process is not just about compliance — it’s about long-term stability, competitiveness and economic transformation,” he said.

REJOINDER TO STEVE OSUJI’S BILE-FILLED RANT: AN EMBITTERED HACK STRUGGLING TO STAY RELEVANT By Ambrose Nwaogwugwu,

Access Holdings posts N642bn profit after tax, 88% gross earnings growth

Nigeria, Japan deepen rice production partnership

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.