Trending

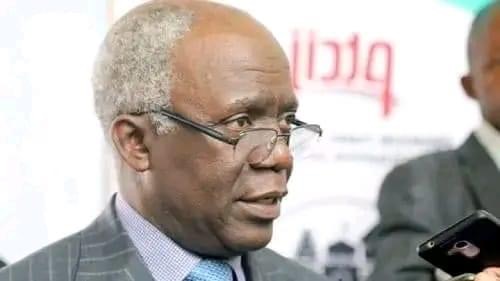

STATE OF THE NATION : CATALOGUE OF LOOTINGS IN NIGERIA By Femi Falana, SAN

Published

8 months agoon

By

Ekwutos Blog

STATE OF THE NATION

CATALOGUE OF LOOTINGS IN NIGERIA

By Femi Falana, SAN

Globally, subsidies, whether for food, transportation, energy or housing, are part of good governance. So, the issue is not subsidies but who benefit from them.

In Nigeria, subsidies are primarily of the rich, by the rich and for the rich.

I will highlight a few, how they are being manipulated and how huge sums of money can be recovered not just to subsidize fuel but also provide funds for development.

1). Diversion of N40 billion from Federation Account

A company, Continental Transfert Technique had been hired by the Ministry of Interior to collect the Combined Expatriate Residence Permit and Alien Card (CERPAC) Fee of $2,000 per annum from every expatriate in Nigeria.

The revenue from 2019 comes to an average of N40 billion per annum.

This collection which violates Section 162 of the Constitution and provisions of the Immigration Act 2015, is then shared on percentages of Federal Government,

30, Interior Ministry, 7, Immigration Service,

and Continental Transfert Technique, 58 per-cent.

We challenged this illegality at the Federal High Court and won the cases.

The court directed the NIS to collect the funds henceforth and remit same to the Federation Account.

But the contractor and the federal government appealed against the judgment and have continued to share the N40 billion per annum

2). Additional Revenue of $1.5 billion payable to Federation Account

In July 2015, I drew the attention of the Federal Government to the fact that the 15-year fiscal incentives given to the oil and gas companies operating under the Deep Offshore and Inland Basin Production Sharing Contracts Act had expired in June 2014.

When the Federal Government ignored our request, we drafted a Bill for the amendment of the law. The Bill which was adopted and sponsored by Senator T. Orji scaled the first reading in the Senate but was not passed before the dissolution of the 8th National Assembly.

However, the same Bill was modified and passed by both houses of the 9th National Assembly and assented to by President Buhari on November 4, 2019. In justifying the passage of this Bill, Senate President Ahmed Lawan announced that the new law would increase the revenue of the nation by not less than $1.5 billion per annum.

3). Outstanding royalties of $62 billion

In campaigning for the amendment of the Deep Offshore and Inland Basin Production Sharing Contracts Act, I requested the Federal Government to collect outstanding royalties payable by the International Oil Companies under the Act.

The Federal Government admitted that the country had lost a whopping sum of $60 billion.

But my demand for the collection of the huge fund was ignored.

The governments of Rivers, Akwa Ibom and Bayelsa States then approached the Supreme Court which on October 20, 2018 ordered the Federal Government to collect the royalties for the past 18 years.

The Federal Government confirmed that the outstanding royalty withheld by the IOCs is $62 billion but has refused to collect it.

4). FG denied revenue of $500 million by a group of corrupt public officers

The international Cargo Tracking Note Scheme to protect international shipping and prevent the movement of dangerous cargo and arms shipments was introduced into Nigeria in 2010 via an agreement between the Nigerian Port Authority and TPMS, a private company.

Barely a year later, the agreement was suspended.

When our attention was drawn to the illegal suspension of the Cargo Tracking Note system, we protested and the suspension was lifted on May 28, 2015 only to be suspended again in 2016.

In 2022, President Buhari issued an executive order which authorized a company to operate the Cargo Tracking Note. But 5 companies sponsored by top government functionaries overruled the President and hijacked the contract.

The company that won the contract has since sued the federal government at the Federal High Court.

Meanwhile, Nigeria has lost at least $500 million while the security of the nation has been compromised by a bunch of corrupt public officers.

5). Sale of public assets and enterprises

Successive regimes have been selling assets and enterprises owned by the Federal Government to members of the ruling class in the name of privatisation. The buyers turned round to engage in asset stripping.

According to the Bureau of Public Enterprises,

between 2004 and 2002, the federal government sold 142 public enterprises to members of the ruling class.

The 10 per cent shares reserved for the staff of every privatised enterprise have been cornered by the so called “core investors” contrary to the provision of section 5(3) òf the Privatization and Commercialization Act.

6). $7 billion fixed in 14 banks

Sometime in 2006, the CBN yanked off $7 billion from the nation’s foreign reserves and fixed it in 14 commercial banks in Nigeria.

The deposit and the accrued interests were not recovered from the banks. When I reported the matter to one one of the anti-graft agencies, the CBN claimed that it had forgiven “the forbearance”.

7). Sale of Heritage Bank, Keystone Bank, Union Bank and Polaris Bank by CBN

The CBN took over Heritage Bank, Keystone Bank, Union Bank and Polaris Bank, spent trillions of Naira to revitalise them only to turn round to sell them under the table. For instance, CBN invested N1.3 trillion in Polaris Bank but sold it for N50 billion.

8). Theft of Crude oil

The Nigerian Extractive Industries Transparency Initiative (NEITI) has revealed that Nigeria lost 619.7 million barrels of crude oil valued at N16.25 trillion ($46.16 billion) to crude oil theft between 2009 and 2020.

Immediate past National Security Adviser, General Babagana said that Nigeria might lose $23 billion in 2023 to crude oil theft.

9). Theft of gold and other solid minerals

The theft of the nation’s mineral resources is not limited to crude as solid minerals are equally smuggled out of the country by highly placed criminal elements.

Former Minister of State for Mines and Steel Development, Dr Uche Ogah recently disclosed that private jets are being used by the rich for gold smuggling in Nigeria.

He stated this at an investigative hearing on $9 billion annual loss to illegal mining and smuggling of gold organised by the Senate Committee on Solid Minerals, Mines, Steel Development and Metallurgy.

During his contribution at the hearing, Senator Orji Uzor Kalu disclosed that Nigeria lost close to $54b from 2012-2018 due to illegal smuggling of gold.

10). AMCON is owed N5.4 trillion by the rich.

A few years ago, commercial banks were going to collapse due to toxic loans taken by members of the ruling class.

To prevent the impending economic doom, the Federal Government set up the Asset Management Corporation of Nigeria (AMCON) to buy off the loans with trillions of Naira provided by the CBN.

AMCON has not been able to recover the loans of N5.4 trillion from about 370 corporate bodies.

11). Indiscriminate import duty waivers

A few privileged members of the business community buy dollars at official rate while they are allowed to import all manners of goods into the country.

In the last 5 years, import duties worth N16 trillion were waived for them.

12). Effort to track and monitor tankers conveying fuel sabotage by NNPC

On August 8, 2018, the Federal Executive Council (FEC) approved the installation of technology monitoring schemes and structures under the Petroleum Equalisation Fund (PEF) for N17 billion.

The technology which was designed to track and monitor tankers conveying fuel and other petroleum products was not acquired while the N17 billion approved for it was diverted.

13). N10 trillion diverted by CEOs of Government enterprises.

The Buhari government revealed on December 19, 2018 that government enterprises including the CBN owed about N10 trillion in unremitted operating surplus as at August 2018. The details were provided. The said sum of N10 trillion remains unpaid.

14). N6 trillion unpaid ground rents by buyers of Government properties

On March 29, 2023, the Senate noted that since 1992, over two million houses across the 36 states and the FCT had been built and allocated to beneficiaries by the federal government without evidence of payment of ground rent on the properties.

Consequently, the Senate set up an Ad Hoc Committee to recover over N6 trillion unpaid ground rents from property owners in the country.

15). Stolen crude oil valued at $29.17 billion

A group of lawyers engaged by NIMASA confirmed that 60.2 million barrels of crude oil valued at $12.7 billion of crude oil was stolen and illegally exported to the United States of America between January 2011 and 2014.

This has not been recovered.

Also, the House of Representatives investigated and confirmed that undeclared crude oil worth $17 billion was exported to global destinations during the same period.

The affected companies are known but government seems to lack the will to bring them to book and recover the sum of $29.7 billion being the value of the stolen crude.

16). Oil theft of N16.25 trillion

The Nigerian Extractive Industries Transparency Initiative (NEITI) revealed that between 2009 and 2020 Nigeria lost 619.7 million barrels of crude oil valued at N16.25 trillion ($46.16 billion) to oil theft. The security forces have not been able to stop the stealing and smuggling of crude oil from Nigeria.

However, Tantita Security Services Nigeria Ltd (TSSNL), a private company discovered pipelines through which crude oil was being diverted from a 40,000 barrel per day Forcados pipeline to the high seas for export.

The indicted oil companies including an IOC involved in this grand theft are yet to be prosecuted.

17). Deduction of collection costs by FIRS & NCS

The Federal Inland Revenue Service and Nigeria Customs Service are allowed by their enabling laws to deduct percentages of the taxes and duties collected by them as collection costs. Thus, the FIRS between 2016 and 2020 made N533.39 billion deductions

while Nigeria Customs Service withdrew N128.64 billion as cost of collection in 2022.

The laws which allow agencies of the Federal Government to deduct collection costs are contrary and inconsistent with section 162 of the Constitution which provides that all revenues collected by the Government of the Federation shall be paid into the Federation Account.

18). Diversion of $6.065 billion approved for turn-around maintenance of refineries

Between 1993 and 2016, successive regimes spent, through the NNPC, about $6.065 billon on the so-called turn around maintenance and rehabilitation of the four refineries at various times.

It is public knowledge that the turn-around maintenance of the refineries was not carried out. Therefore, the contractors should be invited by the EFCC and compelled to refund the said sum of $6.025 billion.

19). Investment in Dangote refinery and rehabilitation of 4 refineries

The Federal Government has invested $2.7 billion in Dangote Refinery while the NNPCL will supply the refinery with 300,000 barrels of crude oil per day.

Furthermore, the Government has awarded the contracts for the rehabilitation of the two refineries in Port Harcourt for $1.5 billion, as well as Kaduna and Warri refineries for $1.4billion.

We are compelled to call on the Nigeria Labour Congress and Trade Union Congress to monitor the ongoing rehabilitation and upgrade of the 4 refineries.

20). Special salaries for top public officers, security votes, and pension for governors

Top public officers have illegally taken themselves out of the general salary structure.

For instance, contrary to section 70 of the Constitution which provides that the salaries and allowances of legislators shall be fixed by the Revenue Allocation Mobilization and Fiscal Commission the members of the National Assembly are paid emoluments ranging from N13 million to N15 million per month.

In addition to their salaries the 36 State Governors are paid security votes running into hundreds of millions per month.

The largesse has since been extended to all senior public officers, including heads of ministries, departments, and agencies of the federal and state governments, as well as local government chairmen.

The security votes paid to senior public officers are about N241 billion per annum.

As if such subsidy is not enough, state governors have been placed on scandalous pension of billions of Naira.

But due to public criticisms, the Lagos State Government has halved the pension for ex-governors while the Governments of Kwara,

Imo, and Zamfara States have abolished the payment of the outrageous pension to former governors and deputies.

We call on all other state governments to emulate the example of the aforementioned 3 state governments.

21). Diversion of dividend and feed gas of $33 billion by NNPCL

Nigeria LNG Limited is jointly owned by Nigeria and the OICs.

The 49% shares of Nigeria in the joint venture were paid for from the Federation Account in 1989. On March 29, 2021, former President Buhari disclosed that the Nigerian Liquefied Natural Gas (NLNG) had generated $114 billion in revenues, paid $9 billion in taxes, $18 billion as dividend and $15 billion in Feed Gas Purchase to the Federal Government.

However, rather than pay the fund into the federation account as constitutionally directed,

the $33.9 billion dividend and feed gas was diverted by the NNPCL.

22). Diversion of trillions of Naira through fuel subsidy fund

Notwithstanding the allocation of 445,000 barrels of crude oil to NNPC per day for domestic consumption, it has been confirmed that the figures for fuel importation in Nigeria between 1999 and 2023 are as follows:

1. 1999-2006 =N813 billion;

2. 2007-2009= N794 billion;

3. 2010-2014= N3.9 trillion;

4. 2015-2023= N11 trillion.

Last week, the Chief Executive Officer of the Nigerian National Petroleum Company Limited (NNPCL), Mr. Mele Kyari stunned the nation when he said that the federal government still owes the company N2.8 trillion in fuel subsidy payments. But the monumental fraud that has characterized the fuel subsidy scam has been confirmed by the Buhari regime.

Thus, on March 27, 2022, former Minister of State for Petroleum Resources, Mr. Timipre Sylva publicly lamented the controversies surrounding the amount of petrol that the nation consumes daily, said the subsidy regime encouraged criminal activities like smuggling, which in turn impact negatively on the nation’s oil resources.

He said that, “I am told the figure sometimes rise to as high as 90 or over 100 million litres.

I don’t know how that happens.

At this rate, I have said if anyone is looking at a criminal enterprise, look no further than the fuel subsidy.”

The criminal enterprise ought to be probed by the Bola Tinubu administration.

CONCLUSION

It is crystal clear from the foregoing that members of the ruling class are heavily subsidized by the peripheral capitalist system

while the masses are subjected to excruciating economic pains.

We are therefore compelled to call on the

Nigeria Labour Congress and Trade Union Congress as well as the progressive extraction of the civil society to mount pressure on the federal government to stop the dollarisation of the national economy, indiscriminate grant of duty waivers, theft of crude oil, gold, and other mineral resources and recover the nation’s looted wealth.

In other words, these ‘subsidies’ should be recovered while the nation’s refineries are fixed so that the country can provide genuine subsidies that can make life livable in Nigeria.

Note:

There is also the recent NIGERIA AIR open lootin

You may like

Trump moves to restore some terminated foreign aid programmes

Two women drown, die in Kano puddle

Congo Frees Jailed Americans After Failed Coup, Hands Them Over to U.S.

INEC Chairman, Mahmood not sacked – Spokesman

BREAKING: Rivers State Sole Administrator Vice Admiral Ibot-Eke Ibas Rtd Appoints Local Government Sole administrators And Reconstituted RISIEC Board.

Gov Soludo welcomes Ifeanyi Ubah’s supporters into APGA, promises to immortalize Late Senator.

Two women have tragically lost their lives in Gezawa Local Government Area of Kano State after reportedly falling into a puddle while attempting to wash their bodies after work at a zobo processing factory.

The incident which occurred on Monday evening, was confirmed in a press release issued on Tuesday by the Kano State Fire Service Public Relations Officer, Assistant Chief Fire Officer Saminu Yusif Abdullahi.

According to the statement, the fire service received an emergency call at about 11:15 a.m. on Tuesday from the commander of a local vigilante group in Gezawa, who reported that the women had entered the puddle with the intention of washing their bodies after closing from work.

“According to their relatives, they are workers in a zobo processing company and entered the water with the intention of washing their bodies after closing from duty, which resulted in the loss of their lives,” the statement said.

Although a search for the victims began on Monday evening, their bodies were only recovered on Tuesday morning. They were found unconscious and handed over to Officer Musa Garba of the Gezawa Police Division.

The fire service did not release the names of the deceased, and further details surrounding the circumstances of the incident remain unclear.

Trending

Pascal Dozie, Founder Of Diamond Bank Passes Away At 85

Published

24 hours agoon

April 8, 2025By

Ekwutos Blog

The founder of the defunct Diamond Bank Plc, Pascal Gabriel Dozie, has died at the age of 85.

According to Business Day, Dozie passed away in the early hours of Tuesday, April 8, 2025.

His death came just a day before his 86th birthday, following a battle with an age-related illness.

Dozie was best known as the founder of Diamond Bank, one of Nigeria’s most innovative financial institutions before its merger with Access Bank.

He served as the bank’s chairman before handing over leadership to his son, Uzoma Dozie.

Dozie is survived by his wife Chinyere Dozie, and five children among other relatives.

Trending

Security forces foil kidnapping in Katsina, one civilian killed

Published

2 days agoon

April 7, 2025By

Ekwutos Blog

A kidnapping attempt was foiled in the early hours of April 5, 2025, in Gidan Yan Ali, Kurba Village, Kankara Local Government Area of Katsina State, after security forces engaged armed bandits in a fierce gun battle.

Intelligence sources told Zagazola Makama that the assailants believed to be part of a larger criminal network stormed the village around 11:45 p.m., setting corn stalks ablaze and attempting to abduct women and livestock.

Prompt deployment of security personnel led to a swift response, forcing the bandits to flee into the nearby bush.

During the confrontation, a villager identified as 40-year-old Murtala Dayyabu Sidi was shot and killed by the attackers.

The intervention of security forces ensured the safe rescue of the kidnapped women and the recovery of stolen animals, which were returned to their rightful owners.

Investigations into the attack are ongoing.

Trump moves to restore some terminated foreign aid programmes

Two women drown, die in Kano puddle

Congo Frees Jailed Americans After Failed Coup, Hands Them Over to U.S.

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.