Business

Stocks Soar: ECB Rate Cut, TSMC Profits Boost Global Markets

Business

Dangote refinery, NNPC: More fuel stations increase pump price in Nigeria

Business

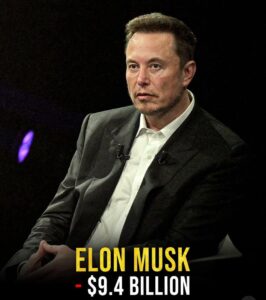

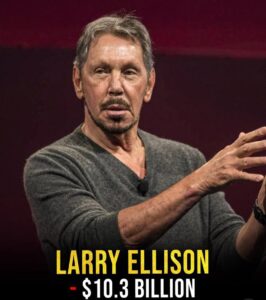

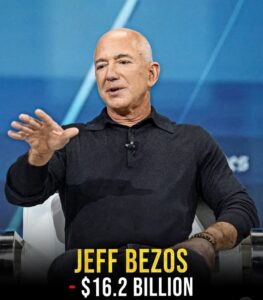

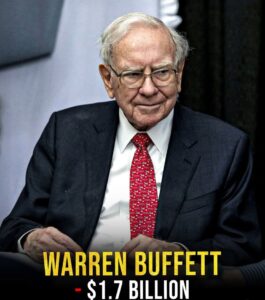

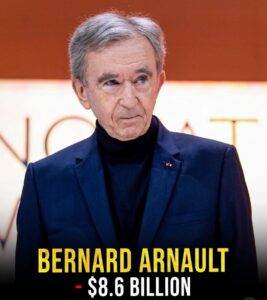

Global Billionaires’ Net Worth Plummets by $65 Billion Amid Market Downturn

Business

Sterling Bank Makes History: Scraps Transfer Fees for Local Online Transactions, Earns Praise from Lawmakers, Including Mohammed Bello El-Rufai, and the Public

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics5 months ago

Politics5 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment5 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics5 months ago

Politics5 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics5 months ago

Politics5 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.