News

Taraba: Residents of Mallam Joda call for urgent road rehabilitation

Published

4 days agoon

By

Ekwutos Blog

Residents of the Mallam Joda area in Jalingo metropolis of Taraba State on Sunday appealed to Governor Agbu Kefas, calling for the immediate rehabilitation of the community’s main access road.

They described the road as “severely deteriorated” and a growing threat to lives and livelihoods.

In a letter signed by concerned residents and addressed to the Government House in Jalingo, the community highlighted the alarming state of the road, citing deep potholes, extensive erosion, and near-total collapse in certain sections.

In the letter signed by Al-Emran Alhassan on behalf of the Mallam Joda community, the residents said the road has reached a critical point where inaction could lead to further economic and social consequences.

“The hazardous state of the road has increased the risk of vehicular accidents, often resulting in injuries, property damage, and delays,” the letter stated.

Residents also lamented how the condition of the road has affected local commerce, hindered access to essential services such as healthcare and education, and exacerbated flooding and erosion due to poor drainage.

Farmers in the area are reportedly facing significant post-harvest losses due to difficulty in transporting their goods to markets, while local businesses are grappling with higher transportation costs. The road’s condition has also delayed emergency response services, including ambulances.

Despite several appeals to the local government, the community says no substantial intervention has been made so far. They are now turning to the state government, urging the governor to take swift and decisive action.

The residents requested that the state government dispatch engineers to assess the road and develop a comprehensive plan for its rehabilitation. They also asked for adequate funding and close supervision of the project to ensure transparency and quality.

“We trust in your leadership and your commitment to the welfare of all Taraba State citizens,” the residents wrote. “We are hopeful that you will act swiftly to alleviate the suffering of the Mallam Joda community.”

You may like

Chimaobi gets four years jail for refusal to accept naira as legal tender

Dollar to Naira exchange rate stands at ₦1,600.80 today

Reject agents of division, exclusion – Fashola to Nigerian youths

Mbah visits Christian Chukwu’s family, pledges to immortalise him

REJOINDER TO STEVE OSUJI’S BILE-FILLED RANT: AN EMBITTERED HACK STRUGGLING TO STAY RELEVANT By Ambrose Nwaogwugwu,

Access Holdings posts N642bn profit after tax, 88% gross earnings growth

News

Chimaobi gets four years jail for refusal to accept naira as legal tender

Published

5 minutes agoon

April 17, 2025By

Ekwutos Blog

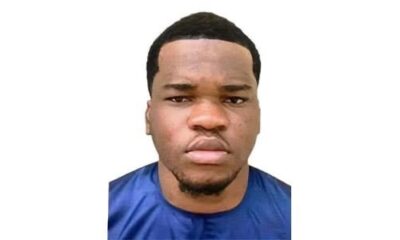

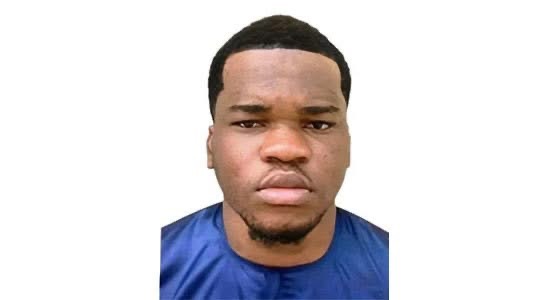

Justice Alexander Owoeye of the Federal High Court sitting in Ikoyi, Lagos, on Tuesday, April 15, 2025, convicted and sentenced one Uzondu Precious Chimaobi to four years imprisonment for his refusal to accept the Naira as a legal tender.

Chimaobi was arraigned by the Lagos Zonal Directorate 1 of the Economic and Financial Crimes Commission, EFCC, Awolowo Road, Ikoyi, Lagos, on February 5, 2025 on a two-count charge bordering on refusal to accept the Naira as a legal tender.

One of the counts reads: “That you, Precious Chimaobi Uzondu, on the 10th of December 2024, in Lagos, within the jurisdiction of this Honourable Court, refused to accept Naira (Nigeria legal tender) by accepting the sum of $5700 as a means of payment for a purchase of a cartier diamond bracelet with serial number (12345678) and you, thereby , committed an offence contrary to Section 20 of the Central Bank of Nigeria Act, 2007.”

Business

Dollar to Naira exchange rate stands at ₦1,600.80 today

Published

18 minutes agoon

April 17, 2025By

Ekwutos Blog

The exchange rate for the US dollar to the naira today is ₦1,600.7991, marking a slight decline of -0.432% compared to yesterday’s rate.

Over the past week, the dollar has shown relative stability against the naira, although it has slipped by -2.094% compared to its value seven days ago.

Within this one-week window, the exchange rate has fluctuated between a high of ₦1,636.71 recorded on April 10, 2025, and a low of ₦1,589.45 on April 14, 2025. The most significant single-day shift happened on April 10, when the naira strengthened, leading to a -2.252% drop in the dollar’s value.

Current Rates:

1 USD = ₦1,600.7991

1 NGN = $0.00062469

US Dollar to Nigerian Naira Conversion Table:

1 USD = ₦1,600.7991

3 USD = ₦4,802.3973

5 USD = ₦8,003.9955

7 USD = ₦11,205.5937

10 USD = ₦16,007.991

12 USD = ₦19,209.5892

15 USD = ₦24,011.9865

25 USD = ₦40,019.9775

30 USD = ₦48,023.973

45 USD = ₦72,035.9595

50 USD = ₦80,039.955

75 USD = ₦120,059.9325

100 USD = ₦160,079.91

300 USD = ₦480,239.73

400 USD = ₦640,319.64

500 USD = ₦800,399.55

750 USD = ₦1,200,599.325

1,000 USD = ₦1,600,799.1

3,000 USD = ₦4,802,397.3

5,000 USD = ₦8,003,995.5

7,500 USD = ₦12,005,993.25

10,000 USD = ₦16,007,991

15,000 USD = ₦24,011,986.5

25,000 USD = ₦40,019,977.5

50,000 USD = ₦80,039,955

75,000 USD = ₦120,059,932.5

100,000 USD = ₦160,079,910

Nigerian Naira to US Dollar Conversion Table:

1 NGN = $0.00062469

3 NGN = $0.00187406

5 NGN = $0.00312344

7 NGN = $0.00437282

10 NGN = $0.00624688

12 NGN = $0.00749626

15 NGN = $0.00937032

25 NGN = $0.0156172

30 NGN = $0.01874064

45 NGN = $0.02811096

50 NGN = $0.0312344

75 NGN = $0.0468516

100 NGN = $0.0624688

300 NGN = $0.1874064

400 NGN = $0.2498752

500 NGN = $0.312344

750 NGN = $0.46851601

1,000 NGN = $0.62468801

3,000 NGN = $1.87406402

5,000 NGN = $3.12344004

7,500 NGN = $4.68516006

10,000 NGN = $6.24688007

15,000 NGN = $9.37032011

25,000 NGN = $15.61720018

50,000 NGN = $31.23440037

75,000 NGN = $46.85160055

100,000 NGN = $62.46880074

Business

Access Holdings posts N642bn profit after tax, 88% gross earnings growth

Published

3 hours agoon

April 17, 2025By

Ekwutos Blog

Access Holdings Plc says it recorded N642 billion as profit after tax in the full year of 2024, up from the N619.32 billion earned at the end of 2023.

In its audited financial statement for the year ended December 31, 2024, Access Holdings said the figure represents a 3.7 percent increase in profit after tax.

The group said its gross earnings grew by 88 percent year-on-year, rising from N2.594 trillion in 2023 to N4.878 trillion in 2024.

“Profit before tax (PBT) increased by 19% to N867.0 billion, while profit after tax (PAT) rose to N642.2 billion, despite inflationary and macroeconomic challenges.”

According to the statement, the bank’s total assets grew by 55.5 percent to N41.498 trillion and customer deposits rose by 47 percent to N22.525 trillion.

The financial institution said shareholders’ funds also increased by 72 percent, reaching N3.76 trillion.

In terms of economic sustainability, the statement noted that the bank recorded strong strides through its economic, social and governance (ESG) programmes.

“It facilitated $437.42 million in DFI inflows to support MSMEs across Africa, disbursed 1.6 million digital loans to low-income individuals, and booked its first N1.4 billion diaspora mortgage loan,” the statement further reads.

“The Group also achieved a 13.4% reduction in operational emissions, planted 57,302 trees, and enabled solar power adoption for 226 homes and businesses.

“Its headquarters was awarded the IFC EDGE (Excellence in Design for Greater Efficiencies) Green Building Certification for sustainable design and construction standards.”

The statement also noted that the bank posted significant gains across all performance metrics, “with interest income growing by 110% and fees and commissions rising by 81%”.

The organisation said international subsidiaries contributed 48.5 percent to the “banking segment’s PBT, demonstrating strong execution across key markets”.

In 2024, Access Holdings said it also became the first institution to comply with the Central Bank of Nigeria’s recapitalisation directive, raising N351 billion through a rights issue.

The group also said it paid N1.243 billion in penalties to regulatory authorities in 2024 for various infractions

JUST IN: Virgil van Dijk signs new two-year deal with Liverpool

Chimaobi gets four years jail for refusal to accept naira as legal tender

Dollar to Naira exchange rate stands at ₦1,600.80 today

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.