Business

UK is SECOND most attractive country for investment according to CEOs

Published

2 months agoon

By

Ekwutos Blog

Booming Britain is the world’s second-favourite place to place to invest – just behind the USA – according to a survey of global business leaders.

Around 14 per cent of the near-5,000 corporate bosses surveyed by PwC say they expect the UK to receive the most international investment in the next year.

The survey, published as the World Economic Forum gets underway in Davos, will be a boon to Chancellor Rachel Reeves after criticism of her Autumn Budget and higher-than-expected inflation.

Experts believe that the UK’s relative stability amid global economic uncertainty makes it a favourite for additional investment – and comes ahead of an expected cut in interest rates by the Bank of England amid rising wages.

Britain’s second-place ranking in the PwC CEO Survey is its best since the poll began 28 years ago, and is two places up from fourth last year.

It came second to the US (30 per cent) – and ahead of Germany, China and India (12, nine and seven per cent respectively).

The results suggest Britain is in a prime spot for an influx of investment as competing nations face growing economic crises.

Germany is in the midst of a years-long recession, while China is battling uncertainty after the EU slapped import tariffs on cars while Donald Trumpmulls over tough taxes for Chinese goods.

Britain has been named the second best place to invest this year in a poll of 5,000 CEOs from 109 countries

The survey has been welcomed by Chancellor Rachel Reeves, who said it was proof CEOs were ‘backing Britain’ under Labour

And 61 per cent of British CEOs say the country is in line for economic growth – up from just 39 per cent last year.

Experts speaking to MailOnline say there are a number of reasons Britain may attract investment from abroad, including in property, where prices are steady amid an ongoing housing shortage.

Jonathan Gordon, director of wealth at property investment firm IP Global, said: ‘In the context of property, the UK offers much needed stability to global investors.

‘This is not just applicable to London, but up and coming markets like Manchester and Birmingham have shown resilience in the face of global turmoil due to a constant flow of demand.’

Responding to the survey, the Chancellor said: ‘These latest results show global CEOs are backing Britain and the UK is one of the most attractive destinations for international investment.

‘And it’s this investment that will help drive economic growth and improve living standards across the UK.’

Marco Amitrano, senior partner at PwC UK, said: ‘Our CEO survey findings are a vote of confidence in the UK as a place for business and investment.

‘The UK’s relative stability at a time of instability should not be underestimated, nor should its strength in key sectors including technology.

‘However, there is no room for complacency.’

The Bank of England (pictured) is expected to announce a cut in interest rates next month amid wage growth in the private sector – a boon for business

There are concerns the UK’s economy is stalling after official figures showed it grew just 0.1 per cent in November, and a run on UK Government bonds, known as gilts.

The survey data suggests more than half of UK CEOs plan to increase the size of their workforce this year – even as the Chancellor imposes hikes in national insurance and a cut in the threshold at which NI is paid from April.

Interest rates are set to be cut next month after wages rose 5.6 per cent in the three months to November, up from 5.2 per cent the previous three months.

But British bosses are also slightly less positive about the future of their own firms than they were before Labour came in – with confidence dropping from 61 per cent in 2024 to 57 per cent now.

David Belle, a broker and founder of Fink Money, has warned that the UK’s weak pound means investors may simply be using Britain to do business on the cheap before taking their money elsewhere.

‘With a weaker sterling and almost zero demand from UK citizens to own shares in UK companies, there is no bid keeping share prices higher like there is in the US, Canada and Australia,’ he told MailOnline.

‘So any foreign investor is going to see the UK as a place where they can buy assets cheap relative to future cash flows.

‘It’s a sleight of hand to hail this as a UK win. In reality, it’s the opposite.’

Rachel Reeves is travelling to the World Economic Forum in Davos this week, where she will urge company bosses to invest in the UK – likely boosted by the survey results and an upgrade of Britain’s forecasted growth by the IMF.

The international body believes Britain will see a 1.6 per cent expansion this year – slightly up from the 1.5 per cent it pencilled in last October.

‘The time to invest in Britain is now,’ she said in a statement.

She had last been seen gallivanting in China to secure £600million of investment – criticised as a meagre amount in a country with a nominal GDP of $18.5trillion –

But Ray Dalio, billionaire founder of hedge fund Bridgewater, told the Financial Times that the UK could be heading for a debt ‘death spiral’ in which it has to borrow more to cover its rising interest costs.

You may like

Trump Liberation Day tariffs to go into effect as markets melt down

Don’t ever have s$x with a drunk person no matter how much pressure they put on you to do so. They might turn it to r@pe- legal practitioner, Deji Adeyanju, advises

My American passport worth more than a million dollars – Davido

LASTMA issues stern warning to mini-bus drivers over traffic violations

How Nigerian celebrities marked April Fool’s Day

Imo State University (IMSU) Admission Requirements: A Comprehensive Guide

Business

Why Aussie consumers could soon be paying DOUBLE for beef

Published

4 hours agoon

April 2, 2025By

Ekwutos Blog

- Small-scale farmers warning of $56/kg rump steaks

- PODCAST: Trump round three, Musk’s breakup with DOGE – and former Denmark ambassador on the ‘smartest thing’ Greenland can do. Listen here

Australian consumers could end up paying more than $50 a kilo for steak at the supermarket as a result of Donald Trump‘s tariffs on agriculture exports, farmers say.

A kilogram of rump steak at Woolworths is now selling for $28.

But the Australian Food Sovereignty Alliance, representing 350 small-scale farmers, fears rump steak will end of costing Australian consumers $56 at the supermarket.

Spokeswoman Tammi Jonas, an organic beef cattle producer from Daylesford in Victoria, said the American tariffs on agricultural imports would see more countries buy Australian beef to avoid trading with the US.

‘We already know there’s high demand for Australian beef around the world and I think that’s just going to get higher,’ she told Daily Mail Australia.

‘In a global supply crunch like this, we could see rump steak climb past $50 per kilogram.

‘That’s not a family dinner – that’s a premium luxury.’

Dr Jonas said higher export prices would see less Australian meat sold to domestic consumers.

Australian consumers could end up paying more than $50 a kilo for steak as a result of Donald Trump ‘s tariffs on agriculture exports, farmers say (pictured is a Coles supermarket)

‘I would say there’s a strong likelihood of that, yes,’ she said.

‘And even if we still have enough beef sold within Australia, the prices are certain to go up.

‘Whenever you’re in those global markets, you roll with the volatility and if they can get a really high price overseas, they’re not going to charge less for domestic sales.’

But Angus Gidley-Baird, a senior analyst in animal protein with RaboResearch, said more expensive steak at the supermarket was unlikely, given the strong supply of Australian beef with the recent rainfall.

‘We produced record volumes of beef last year, I don’t see why there would be a shortage in the domestic market that would cause prices to rise,’ he told Daily Mail Australia.

‘The exports are effectively our markets that we sell the additional production into.’

Meat and Livestock Australia data showed the US was Australia’s biggest market for beef exports in 2024, putting it well ahead of Japan, South Korea and China.

Of the beef sent to the United States, 96 per cent of it was the leaner, grass fed variety that was either chilled or frozen.

The Australian Food Sovereignty Alliance fears rump steak will end of costing Australian consumers $56 at the supermarket. Spokeswoman Tammi Jonas (left) said the American tariffs on agricultural imports would see more countries buy Australian beef to avoid trading with the US

The Americans have been in the grip of a drought, and most of their beef is fattier, grain-fed.

South American beef exporters Argentina and Brazil are also dealing with a lack of rainfall, which means demand for Australian beef would continue to be strong.

Mr Gidley-Baird said the Americans, who produced fattier, grain-fed beef, would still need the leaner, Australian grass-fed beef to make hamburger patties, regardless of import tariffs.

‘The US still continues to need imported product because they’re not producing as much themselves,’ he said.

‘They’ll still need Australian beef – the drought, it’s getting better in the US but they’ve liquidated their herd and production volumes are down.

‘What Australia sends to the US complements their production system over there in that it balances out the fatter product they’re producing for hamburger production.

‘They need the product and we’re one of the biggest suppliers of it – me being rational would still say that they would still buy it.’

At the margins, strong American demand for grass-fed beef had pushed up prices for Australian lean mince, now selling for $15.50 a kilo at Woolworths.

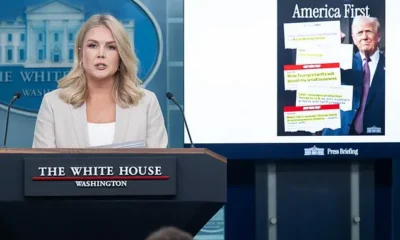

The Trump Administration’s tariffs of up to 25 per cent on agricultural imports are coming into affect on Thursday, along with tariffs on pharmaceutical products (President Donald Trump is pictured in the White House)

‘The US market has been very strong – it’s demanding a fair amount of product which is putting a bit of pressure on mince prices, lean product prices,’ Mr Gidley-Baird said.

The Australian Food Sovereignty Alliance sees mince prices more than doubling to $36 a kilo.

But Dr Jonas predicted possible tariffs of up to 25 per cent on Australian beef would see American demand plunge, despite the fact they are in drought with an undersupply of grass-fed beef.

‘I think with a 25 per cent tariff they won’t be able to afford it – Americans are in as big a cost-of-living crisis as Australians are and they can’t handle a 25 per cent tariff on top of the higher meat price of imported Australian beef,’ she said.

The Australian Food Sovereignty Alliance didn’t do specific economic modelling on Australian beef prices, as a result of the Trump tariffs on agriculture coming into effect on Thursday.

But it argued China’s African swine flu in 2019 led to a doubling of pork prices, as supply fell by 40 per cent.

The alliance campaigns against agribusiness giants like JBS Foods Australia, which owns feedlots and abattoirs.

‘The local farmers like us are losing access to the facilities to slaughter,’ Dr Jonas said.

‘While that sounds like a good thing for Australia – when we think, “We can export more” – the reality of that is very few people profit from that higher export.’

The Trump Administration’s tariffs of up to 25 per cent on agricultural imports are coming into effect on Thursday, along with tariffs on pharmaceutical products.

‘If it’s a large tariff but applied to everyone, our competitive position remains the same,’ Mr Gidley-Baird said.

They follow 25 per cent tariffs on steel and aluminium, introduced on March 12.

Business

BREAKING: Tinubu sacks NNPCL CEO, Mele Kyari, appoints Bayo Ojulari

Published

9 hours agoon

April 2, 2025By

Ekwutos Blog

President Bola Tinubu has sacked the Group Chief Executive Officer (CEO) of the Nigerian National Petroleum Company Limited, NNPCL, Mele Kyari.

Tinubu also dissolved its board, removing the Chairman, Chief Pius Akinyelure.

Bayo Onanuga, Special Adviser to the President on information and strategy, announced this in a statement on Wednesday.

Onanuga said Tinubu invoked his powers under section 59(2) of the Petroleum Industry Act (PIA) 2021 to carry out the sweeping reconstitution, citing the need for “enhanced operational efficiency, restored investor confidence, and a more commercially viable NNPC”.

He announced that Tinubu has now approved a new 11-man board, which has Engineer Bashir Bayo Ojulari as the Group CEO and Ahmadu Musa Kida as non-executive chairman.

According to the statement, “Adedapo Segun, who replaced Umaru Isa Ajiya as the chief financial officer last November, has been appointed to the new board by President Tinubu.

“Six board members, non-executive directors, represent the country’s geopolitical zones. They are Bello Rabiu, North West, Yusuf Usman, North East, and Babs Omotowa, a former managing director of the Nigerian Liquified Natural Gas( NLNG), who represents North Central.

“President Tinubu appointed Austin Avuru as a non-executive director from the South-South, David Ige as a Non-executive director from the South West, and Henry Obih as a non-executive director from the South East.

“Mrs Lydia Shehu Jafiya, permanent secretary of the Federal Ministry of Finance, will represent the ministry on the new board, while Aminu Said Ahmed will represent the Ministry of Petroleum Resources”.

He added said that all the appointments are effective today, April 2.

Business

Aliko Dangote, Femi Otedola, Mike Adenuga, and Abdulsamad Rabiu have been named in the 2025 Forbes billionaires list, released on Saturday, March 29.

Published

3 days agoon

March 30, 2025By

Ekwutos Blog

The four businessmen are the only Nigerians to feature on the prestigious lineup, with Dangote leading the continent’s wealthiest individuals.

Dangote, the owner of Dangote Refinery, has seen a significant increase in his net worth, rising from $13.9 billion in 2024 to $23.9 billion, securing his position as Africa’s richest person for the 14th consecutive year. “Aliko Dangote of Nigeria tops the list for the 14th year in a row with an estimated net worth of $23.9 billion, up from $13.9 billion a year ago,” Forbes stated. “The big jump in his fortune is primarily due to Forbes adding the value of his refinery, which opened last year on the outskirts of Lagos after long delays.”

Adenuga, chairman of Globacom, was ranked as the fifth richest African with a net worth of $6.8 billion, while Rabiu of BUA Group followed in sixth place with an estimated $5.1 billion. Otedola, chairman of First Bank of Nigeria (FBN) Holdings Plc, was listed in joint 16th place with a net worth of $1.5 billion.

Forbes highlighted Otedola’s growing fortune, stating, “Another billionaire whose fortune grew more than 30%: Femi Otedola of Nigeria (No. 18, $1.5 billion), chairman of listed power generation firm Geregu Power Plc. Shares of Geregu surged some 40% in the past year following a jump in revenue and profits. Two African billionaires who made the list in the past and then fell off are back on again.”

The report further revealed that South Africa led the continent with the highest number of billionaires, boasting seven individuals on the list, followed by Nigeria and Egypt with four each. Morocco had three billionaires, while Algeria, Tanzania, and Zimbabwe each had one.

Forbes described 2025 as a historic year for Africa’s wealthiest individuals, with the cumulative wealth of the continent’s billionaires surpassing $100 billion for the first time. “Africa’s 22 billionaires saw their fortunes rise to a total of $105 billion, up from $82.4 billion and 20 billionaires last year. It’s no small feat to generate this”…

Trump Liberation Day tariffs to go into effect as markets melt down

Don’t ever have s$x with a drunk person no matter how much pressure they put on you to do so. They might turn it to r@pe- legal practitioner, Deji Adeyanju, advises

My American passport worth more than a million dollars – Davido

Trending

Trending5 months ago

Trending5 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business5 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics5 months ago

Politics5 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment5 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment5 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics5 months ago

Politics5 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics5 months ago

Politics5 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.