Business

Wales ‘should get a lot more’ of UK’s rail cash

Published

6 months agoon

By

Ekwutos BlogThe Welsh economy is losing out because of a lack of rail investment, a transport expert has said.

Prof Mark Barry said Wales should be getting a lot more money, but because spending was controlled from Whitehall, England was more of a priority.

The first minister said she was doing everything she could to get more cash for the country’s railways.

The Welsh Conservatives said Wales should be getting its fair share of HS2 funding.

The Labour UK government said investment was key to its priorities, but rail investment was run from the Department for Transport in London rather than the Welsh government.

Prof Barry, from Cardiff University, said that meant Wales was down the queue for cash.

He said: “We get about 1 to 2% of the funding available but should get a lot more.

“In an ideal world you’d be looking at 5 or 6% of the total UK investment in rail enhancement, but if you don’t invest in essential economic infrastructure – specifically in energy, transport and housing – then you can’t really expect your economy to turn a corner.”

He said the amount of cash Wales was asking for was tiny compared with what had already been committed to English railways.

“The TransPennine Express Group Upgrade is a £10bn capital programme over 15 years,” he said.

“In Wales we’ve worked up over the last five years £2-3bn in very good business cases for rail investment, and the challenge is how is that going to get funded?”

Earlier this year Welsh ministers confirmed they would not go to court to seek billions of pounds extra to spend following high speed rail investment in England

© PA Media

In recent years the biggest argument has been about extra funding for Wales from the HS2 project.

In opposition, Labour said the HS2 rail link should be an England only scheme and Wales should get money as a result.

First Minister Eluned Morgan said she had spoken to the UK chancellor about a dividend for Wales.

Opposition parties want to see Wales press for the cash, an estimated £4-5bn, which they have said would pay for much improvement.

Leader of the Welsh Conservatives, Andrew RT Davies MS said: “We need to make sure that happens so that we can spend it on infrastructure and improvement in our transport operations here in Wales, and that needs to happen, and we were told that it was a turning of the page if Labour came into government on 4 July.

“Well if that page is turned, let’s have that money, and let Eluned Morgan live up to what she’s professing to do, which is to stand up for Wales.”

‘Investment in Welsh rail’

But the UK government’s Welsh secretary Jo Stevens seemed to close the door on that idea when she was asked about it in Parliament earlier this month.

Plaid Cymru’s parliamentary leader, Liz Saville-Roberts, told the Commons: “The truth is that the railways are broken and Labour’s plan fails to address the chronic underfunding that is the cause, particularly in Wales.

“In 2022, the secretary of state – then the shadow secretary of state – said that it was ‘utterly illogical’ to designate HS2 as an England and Wales project, and called on the Conservatives to ‘cough up’ the billions owed to Wales.

“Will she cough up now?”

In response, Ms Stevens said: “We cannot go back in time and change the way a project was commissioned, managed and classified by the previous Conservative government.

“They need to accept responsibility for the chaos, delay and waste on their watch.

“What we can do though is work closely with our Senedd and local authority colleagues to develop and invest in transport projects that improve services for passengers right across Wales.”

In a statement, Ms Stevens’ department the Wales Office reaffirmed what she had said in the Commons and added: “Following years of neglect, this new UK government recognises the importance of investing in rail infrastructure in Wales.

“The Welsh secretary has already met with the transport secretary to discuss investment in Welsh rail.”

It added that Ms Stevens was working closely with the Welsh government to identify a range of improvements.

“Alongside this the transport secretary is currently carrying out a review of the previous government’s transport commitments which will ensure our transport infrastructure portfolio drives economic growth and delivers value for money for taxpayers.”

In just over a month, the Chancellor Rachel Reeves will deliver a Budget which is expected to set the course for what the government plans to do on investment.

You may like

Otti orders investigation as Fire Service officials switch off phones during fire disaster in Aba

As a L£gally married w0man. Atanda, how long do i need to wait before getting married to another man L£gally in case if my husband kpai? I hope there will be no need for Div0rce again

Supreme Court: Abure’s sack will restore peace, order in LP – Otti

1984 riots: Court records statement of former chief of Delhi Sikh body against Jagdish Tytler

Zinoleesky Welcomes New Addition to His Family

Police Arrest Impostor In Uniform For Inciting Comment Against Edo People On Social Media

Business

Dangote refinery, NNPC: More fuel stations increase pump price in Nigeria

Published

19 hours agoon

April 4, 2025By

Ekwutos Blog

The price of Premium Motor Spirit, popularly known as fuel, has recorded a significant increase in the past days, which may worsen the economic hardship Nigerians face.

MRS, a filling station partner of Dangote Refinery, kicked off the latest fuel price increase when it adjusted its petrol pump to between N925 and N950 per litre in Lagos and the Federal Capital Territory, Abuja.

Similarly, other fuel marketers such as Empire Energy, Recoil, Juda Oil, Total, Emedab, and others also increased their fuel pump to between N950 and N970 per litre.

On Wednesday, the Nigerian National Petroleum Company Limited retail outlets also jacked up their fuel price to N950 per litre from N880 in Abuja.

Summarily, Ekwutosblog observed motorists will have to pay N70 more to buy a litre of petrol in the coming days.

The development comes amid the suspension of petrol product sales in Naira by Dangote Refinery. This follows the initiation of the naira-for-crude sale deal between Dangote Refinery and the federal government through NNPCL.

On Wednesday, President Bola Ahmed Tinubu announced a reshuffling of NNPCL.

Meanwhile, local oil prices are increasing in Nigeria, despite the decline in global crude prices. As of the time of this report, United States West Texas Intermediate was at $62.15 per barrel, down from above $65, while Brent crude stood at $65.42 per barrel, down from $72 last week.

Business

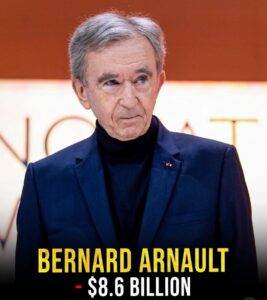

Global Billionaires’ Net Worth Plummets by $65 Billion Amid Market Downturn

Published

1 day agoon

April 4, 2025By

Ekwutos Blog

In a significant setback, the world’s wealthiest individuals collectively lost over $65 billion in net worth today, as key market sectors experienced a sharp downturn.

This decline affected prominent figures in technology, finance, and other industries, sending shockwaves through financial markets.

Ekwutosblog reports that the downturn occurs amidst cautious optimism that new US policies may not be as severe as initially feared.

However, the immediate impact has already been felt, leading to a decline in the net worth of billionaires such as Elon Musk, Warren Buffett, and Jeff Bezos, amongst others who have significant stakes in tech, finance, and other industries.

The global billionaire population has been growing, with over 2,850 individuals representing almost $15 trillion in wealth.

Despite this growth, the market downturn serves as a reminder of the volatility and risks associated with wealth concentration.

Business

Sterling Bank Makes History: Scraps Transfer Fees for Local Online Transactions, Earns Praise from Lawmakers, Including Mohammed Bello El-Rufai, and the Public

Published

2 days agoon

April 3, 2025By

Ekwutos Blog

Sterling Bank has taken a groundbreaking step to ease the financial burden on Nigerians by eliminating transfer fees and other charges for local online transactions.

This move is a significant stride towards financial inclusion and customer-centric banking, particularly during a time when economic pressures are high.

Ekwutosblog gathered that this initiative has been commended by Mohammed Bello El-Rufai, Chairman of the House Committee on Banking Regulations, who praised Sterling Bank’s commitment to creating a more accessible and equitable banking system.

El-Rufai encouraged other financial institutions to follow Sterling Bank’s example, emphasizing that a competitive banking sector prioritizing Nigerians’ interests will strengthen the economy and rebuild public trust in financial services.

Sterling Bank’s decision to scrap transfer fees is expected to benefit individuals and small business owners who frequently make online transactions. The bank’s customers can now perform local transfers via the mobile app without incurring any charges. Obinna Ukachukwu, Growth Executive at Sterling Bank, stated that access to one’s own money shouldn’t come with a penalty, highlighting the bank’s values-driven approach to customer-centric banking.

This move has sparked widespread public approval, with many calling on other banks to adopt similar policies.

As policymakers, El-Rufai reiterated their commitment to fostering a regulatory environment that encourages pro-customer initiatives while ensuring sustainability within the banking sector.

Otti orders investigation as Fire Service officials switch off phones during fire disaster in Aba

As a L£gally married w0man. Atanda, how long do i need to wait before getting married to another man L£gally in case if my husband kpai? I hope there will be no need for Div0rce again

Supreme Court: Abure’s sack will restore peace, order in LP – Otti

Trending

Trending5 months ago

Trending5 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics5 months ago

Politics5 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment5 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment5 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics5 months ago

Politics5 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics5 months ago

Politics5 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.