Business

Why Aussie consumers could soon be paying DOUBLE for beef

Published

3 days agoon

By

Ekwutos Blog

- Small-scale farmers warning of $56/kg rump steaks

- PODCAST: Trump round three, Musk’s breakup with DOGE – and former Denmark ambassador on the ‘smartest thing’ Greenland can do. Listen here

Australian consumers could end up paying more than $50 a kilo for steak at the supermarket as a result of Donald Trump‘s tariffs on agriculture exports, farmers say.

A kilogram of rump steak at Woolworths is now selling for $28.

But the Australian Food Sovereignty Alliance, representing 350 small-scale farmers, fears rump steak will end of costing Australian consumers $56 at the supermarket.

Spokeswoman Tammi Jonas, an organic beef cattle producer from Daylesford in Victoria, said the American tariffs on agricultural imports would see more countries buy Australian beef to avoid trading with the US.

‘We already know there’s high demand for Australian beef around the world and I think that’s just going to get higher,’ she told Daily Mail Australia.

‘In a global supply crunch like this, we could see rump steak climb past $50 per kilogram.

‘That’s not a family dinner – that’s a premium luxury.’

Dr Jonas said higher export prices would see less Australian meat sold to domestic consumers.

Australian consumers could end up paying more than $50 a kilo for steak as a result of Donald Trump ‘s tariffs on agriculture exports, farmers say (pictured is a Coles supermarket)

‘I would say there’s a strong likelihood of that, yes,’ she said.

‘And even if we still have enough beef sold within Australia, the prices are certain to go up.

‘Whenever you’re in those global markets, you roll with the volatility and if they can get a really high price overseas, they’re not going to charge less for domestic sales.’

But Angus Gidley-Baird, a senior analyst in animal protein with RaboResearch, said more expensive steak at the supermarket was unlikely, given the strong supply of Australian beef with the recent rainfall.

‘We produced record volumes of beef last year, I don’t see why there would be a shortage in the domestic market that would cause prices to rise,’ he told Daily Mail Australia.

‘The exports are effectively our markets that we sell the additional production into.’

Meat and Livestock Australia data showed the US was Australia’s biggest market for beef exports in 2024, putting it well ahead of Japan, South Korea and China.

Of the beef sent to the United States, 96 per cent of it was the leaner, grass fed variety that was either chilled or frozen.

The Australian Food Sovereignty Alliance fears rump steak will end of costing Australian consumers $56 at the supermarket. Spokeswoman Tammi Jonas (left) said the American tariffs on agricultural imports would see more countries buy Australian beef to avoid trading with the US

The Americans have been in the grip of a drought, and most of their beef is fattier, grain-fed.

South American beef exporters Argentina and Brazil are also dealing with a lack of rainfall, which means demand for Australian beef would continue to be strong.

Mr Gidley-Baird said the Americans, who produced fattier, grain-fed beef, would still need the leaner, Australian grass-fed beef to make hamburger patties, regardless of import tariffs.

‘The US still continues to need imported product because they’re not producing as much themselves,’ he said.

‘They’ll still need Australian beef – the drought, it’s getting better in the US but they’ve liquidated their herd and production volumes are down.

‘What Australia sends to the US complements their production system over there in that it balances out the fatter product they’re producing for hamburger production.

‘They need the product and we’re one of the biggest suppliers of it – me being rational would still say that they would still buy it.’

At the margins, strong American demand for grass-fed beef had pushed up prices for Australian lean mince, now selling for $15.50 a kilo at Woolworths.

The Trump Administration’s tariffs of up to 25 per cent on agricultural imports are coming into affect on Thursday, along with tariffs on pharmaceutical products (President Donald Trump is pictured in the White House)

‘The US market has been very strong – it’s demanding a fair amount of product which is putting a bit of pressure on mince prices, lean product prices,’ Mr Gidley-Baird said.

The Australian Food Sovereignty Alliance sees mince prices more than doubling to $36 a kilo.

But Dr Jonas predicted possible tariffs of up to 25 per cent on Australian beef would see American demand plunge, despite the fact they are in drought with an undersupply of grass-fed beef.

‘I think with a 25 per cent tariff they won’t be able to afford it – Americans are in as big a cost-of-living crisis as Australians are and they can’t handle a 25 per cent tariff on top of the higher meat price of imported Australian beef,’ she said.

The Australian Food Sovereignty Alliance didn’t do specific economic modelling on Australian beef prices, as a result of the Trump tariffs on agriculture coming into effect on Thursday.

But it argued China’s African swine flu in 2019 led to a doubling of pork prices, as supply fell by 40 per cent.

The alliance campaigns against agribusiness giants like JBS Foods Australia, which owns feedlots and abattoirs.

‘The local farmers like us are losing access to the facilities to slaughter,’ Dr Jonas said.

‘While that sounds like a good thing for Australia – when we think, “We can export more” – the reality of that is very few people profit from that higher export.’

The Trump Administration’s tariffs of up to 25 per cent on agricultural imports are coming into effect on Thursday, along with tariffs on pharmaceutical products.

‘If it’s a large tariff but applied to everyone, our competitive position remains the same,’ Mr Gidley-Baird said.

They follow 25 per cent tariffs on steel and aluminium, introduced on March 12.

You may like

My landlord wants to start a fish pond opposite my flat, I spoke to him and he refused to remove it. What L£gal action can I take aga’inst him Atanda?

Supreme Court cancels five-year ban on lmo Attorney General Akaolisa

Minister of Education, Dr Tunji Alausa Advocates Extension Of NYSC Scheme To Two Years

Joe Igbokwe urges Gov Soludo to investigate native doctor Akwa Okuko

Otti orders investigation as Fire Service officials switch off phones during fire disaster in Aba

As a L£gally married w0man. Atanda, how long do i need to wait before getting married to another man L£gally in case if my husband kpai? I hope there will be no need for Div0rce again

Business

Dangote refinery, NNPC: More fuel stations increase pump price in Nigeria

Published

23 hours agoon

April 4, 2025By

Ekwutos Blog

The price of Premium Motor Spirit, popularly known as fuel, has recorded a significant increase in the past days, which may worsen the economic hardship Nigerians face.

MRS, a filling station partner of Dangote Refinery, kicked off the latest fuel price increase when it adjusted its petrol pump to between N925 and N950 per litre in Lagos and the Federal Capital Territory, Abuja.

Similarly, other fuel marketers such as Empire Energy, Recoil, Juda Oil, Total, Emedab, and others also increased their fuel pump to between N950 and N970 per litre.

On Wednesday, the Nigerian National Petroleum Company Limited retail outlets also jacked up their fuel price to N950 per litre from N880 in Abuja.

Summarily, Ekwutosblog observed motorists will have to pay N70 more to buy a litre of petrol in the coming days.

The development comes amid the suspension of petrol product sales in Naira by Dangote Refinery. This follows the initiation of the naira-for-crude sale deal between Dangote Refinery and the federal government through NNPCL.

On Wednesday, President Bola Ahmed Tinubu announced a reshuffling of NNPCL.

Meanwhile, local oil prices are increasing in Nigeria, despite the decline in global crude prices. As of the time of this report, United States West Texas Intermediate was at $62.15 per barrel, down from above $65, while Brent crude stood at $65.42 per barrel, down from $72 last week.

Business

Global Billionaires’ Net Worth Plummets by $65 Billion Amid Market Downturn

Published

2 days agoon

April 4, 2025By

Ekwutos Blog

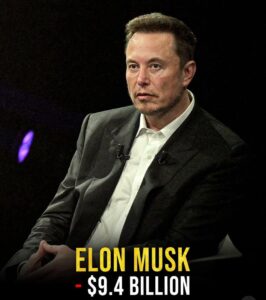

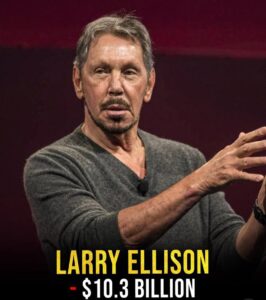

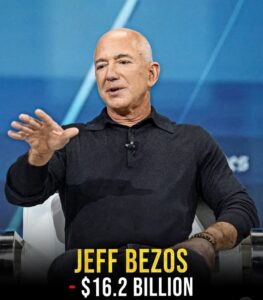

In a significant setback, the world’s wealthiest individuals collectively lost over $65 billion in net worth today, as key market sectors experienced a sharp downturn.

This decline affected prominent figures in technology, finance, and other industries, sending shockwaves through financial markets.

Ekwutosblog reports that the downturn occurs amidst cautious optimism that new US policies may not be as severe as initially feared.

However, the immediate impact has already been felt, leading to a decline in the net worth of billionaires such as Elon Musk, Warren Buffett, and Jeff Bezos, amongst others who have significant stakes in tech, finance, and other industries.

The global billionaire population has been growing, with over 2,850 individuals representing almost $15 trillion in wealth.

Despite this growth, the market downturn serves as a reminder of the volatility and risks associated with wealth concentration.

Business

Sterling Bank Makes History: Scraps Transfer Fees for Local Online Transactions, Earns Praise from Lawmakers, Including Mohammed Bello El-Rufai, and the Public

Published

2 days agoon

April 3, 2025By

Ekwutos Blog

Sterling Bank has taken a groundbreaking step to ease the financial burden on Nigerians by eliminating transfer fees and other charges for local online transactions.

This move is a significant stride towards financial inclusion and customer-centric banking, particularly during a time when economic pressures are high.

Ekwutosblog gathered that this initiative has been commended by Mohammed Bello El-Rufai, Chairman of the House Committee on Banking Regulations, who praised Sterling Bank’s commitment to creating a more accessible and equitable banking system.

El-Rufai encouraged other financial institutions to follow Sterling Bank’s example, emphasizing that a competitive banking sector prioritizing Nigerians’ interests will strengthen the economy and rebuild public trust in financial services.

Sterling Bank’s decision to scrap transfer fees is expected to benefit individuals and small business owners who frequently make online transactions. The bank’s customers can now perform local transfers via the mobile app without incurring any charges. Obinna Ukachukwu, Growth Executive at Sterling Bank, stated that access to one’s own money shouldn’t come with a penalty, highlighting the bank’s values-driven approach to customer-centric banking.

This move has sparked widespread public approval, with many calling on other banks to adopt similar policies.

As policymakers, El-Rufai reiterated their commitment to fostering a regulatory environment that encourages pro-customer initiatives while ensuring sustainability within the banking sector.

My landlord wants to start a fish pond opposite my flat, I spoke to him and he refused to remove it. What L£gal action can I take aga’inst him Atanda?

Supreme Court cancels five-year ban on lmo Attorney General Akaolisa

Minister of Education, Dr Tunji Alausa Advocates Extension Of NYSC Scheme To Two Years

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics5 months ago

Politics5 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment5 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics5 months ago

Politics5 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics5 months ago

Politics5 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.