Tech

CBN fines Moniepoint and OPay ₦1 Billion each as Nigeria tightens fintech regulation

Published

4 months agoon

By

Ekwutos Blog

In a continuation of the Central Bank of Nigeria’s (CBN) increased scrutiny of fintech startups, two of the country’s most prominent unicorns, Moniepoint and OPay, were fined ₦1 billion each in the second quarter of 2024, sources with direct knowledge of the matter told TechCabal. While several other fintech companies were also penalized, the two firms were the hardest hit.

The penalties followed a routine CBN audit of the fintech sector, which revealed compliance issues. According to two sources familiar with the process, these regulatory checks are a standard procedure for banks and financial institutions under CBN oversight.

At least four other fintech companies were similarly penalized, though the details of these fines remain unknown.

The CBN has increasingly relied on fines to enforce regulatory compliance. In 2023, Nigerian banks paid a combined ₦678 million in penalties. In October 2024, the central bank and the Securities and Exchange Commission (SEC) imposed a ₦15 billion fine on ten commercial banks, including Zenith and GTBank, for various infractions in the first half of the year.

Until recently, Nigeria’s rapidly growing fintech sector largely operated without CBN interference. However, the rapid expansion of fintechs like OPay and Moniepoint, which now serve millions of users, has invited greater scrutiny. OPay, for instance, claims a customer base of around 40 million, while Moniepoint, which processed 5.2 billion transactions in 2023, does not disclose specific customer numbers but is similarly large.

Kindly follow Ekwutosblog for verified News and Current Affairs in addition to insightful contents that inform, inspire, educate and entertain you always.

You may like

Police arrest singer Portable over alleged criminal defamation

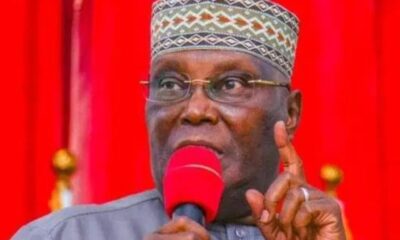

Nigeria does not deserve leader like Tinubu – Atiku on US court order to FBI

Army decries poor enlistment from SE, urges youths to join military

Abia Judiciary Panel investigates alleged demolition of school building for NALDA project

DISCLAIMER: FEDERAL CIVIL SERVICE COMMISSION DISOWNS FICTITIOUS CANDIDATES’ SHORTLISTS

WHAT PRESIDENT TINUBU DISCUSSED WITH US PRESIDENT TRUMP’S ADVISOR

By Adegboyega Adeleye

The importance of cars in transportation cannot be overemphasised with some countries known for their production.

Transportation is required for work, school, and industry, with car production fast becoming a major producer of revenue and a player in the global was financial market.

Car production is one of the largest economic sectors internationally; however, some countries produce more cars than others. The list of countries by motor vehicle production is based on statistics by the International Organization of Motor Vehicle Manufacturers.

The world’s car manufacturers put another 93.5 million vehicles on the roads in 2023, the last full-year numbers currently available.

This article will explore the top 5 countries with the highest car production.

1. China

China, the world’s biggest manufacturer overall, leads the world in car production. The country’s 2023 production totaled more than 30 million vehicles, adding up to more than 30% of all cars and trucks produced globally.

The largest domestic car manufacturers in China, known as the traditional “Big Four,” are SAIC Motor, Dongfeng, FAW, and Chang’an.

2. United States

The United States–a major automotive producer, known for its large vehicle market–is the second biggest auto manufacturing country with a volume of 10,611,555. This represents about 5.5 percent growth compared to the 10,060,339 produced in 2022.

The United States produces less than half of what China does, having manufactured about 1.8 million cars and 8.3 million commercial vehicles in 2022. The United States’ largest car manufacturers, referred to as the “Big Three,” are General Motors, Ford Motor Company, and Fiat Chrysler.

3. Japan

Japan ranked as the third biggest automobile-producing country in the world with a total volume of 8,997,440 vehicles manufactured in 2023. The country is a significant player in the global automotive industry, known for its engineering and quality.

After a sudden drop in production from 2020-2022 due to the COVID-19 pandemic, Japan produced just under 9 million vehicles in 2023 (8,997,440)–a drop from its pre-COVID total of nearly 9.7 million in 2019.

However, the volume grew by 14.8 percent compared to the 7,835,519 produced in 2022.

Japan’s automotive industry is one of the largest industries in the world. The country’s automotive manufacturers include Toyota, Honda, Daihatsu, Nissan, Suzuki, Mazda, Mitsubishi, Subaru, Isuzu, etc.

4. India

India is the fourth-largest automobile-producing country in the world with a total number of 5,851,507 manufactured in 2023. The volume of vehicles grew by 7.2 percent compared to 5,456,857 vehicles produced in 2022.

Although, India is not renowned in America or Europe as a vehicle manufacturer, the Asian nation produced 5.8 million cars in 2023– an annual increase of 7%. India’s export markets for vehicles include Saudi Arabia, South Africa, and Mexico.

The nation is rapidly growing as an automotive market and producer.

5. South Korea

South Korea is the fifth-largest auto-producing country in the world. The country manufactured a total of 4,244,000 vehicles in 2023, representing a growth of 13 percent from a total of 3,757,049 vehicles produced in 2022.

The major South Korean automobile manufacturers include GM Korea, Hyundai Motor Group and its affiliate, Kia Corporation along with Renault Korea Motors.

Tech

A lot of people don’t know this but do you know that all your internet connections and services are powered by Glo, not all but majority is powered by an under see cable called GLO1 THAT’S owned by Glo1.

Published

15 hours agoon

April 13, 2025By

Ekwutos Blog

Now because they make more money from this than selling as retailers that’s why they don’t care about their ISP SERVICE in retail quantities.

It’s like a bakery, they are most focused on selling to bulk buyers than single house hold user’s.

So you MTN, GLO AND ALL THAT are mostly connected to GLO1 even banks and may other platforms.

Ok let me break everything down.

1. Glo’s GLO-1 Cable:

GLO-1 is a private submarine cable owned by Globacom. It stretches from Nigeria to the UK and connects several West African countries. It was Nigeria’s first privately owned international submarine cable, launched around 2010.

Key Facts about GLO-1:

• Length: Over 10,000 km.

• Capacity: Designed for up to 2.5 Tbps.

• Landfall points: UK, Portugal, Senegal, Côte d’Ivoire, Ghana, and Nigeria.

• Purpose: Meant to reduce dependence on SAT-3 and provide high-speed internet capacity.

⸻

2. Why Glo May Not Focus Heavily on Retail ISP Services:

Glo essentially plays two roles:

• Infrastructure owner (wholesaler)

• Internet provider (retailer)

The wholesaling of the GLO-1 cable (and other bandwidth infrastructure) can be significantly more profitable and less stressful than managing millions of data subscribers in Nigeria with high expectations and poor last-mile infrastructure.

So yes:

Glo likely focuses more on selling bulk bandwidth to big clients than pleasing end users.

⸻

3. Who Are Glo’s GLO-1 Subscribers (Wholesale Clients)?

These can include:

• Telecom companies: ISPs, other mobile network operators.

• Banks and financial institutions.

• Tech companies and data centers.

• Government institutions.

• Educational institutions (for broadband research/academic access).

• CDNs and enterprise clients (e.g., Netflix, Google, Meta might use transit partners who tap into GLO-1).

4. How Many Submarine Cables Does Glo Own?

• Only One: GLO-1 is the only submarine cable Globacom directly owns.

• However, Glo might lease or partner to access others like:

• SAT-3 (older system, via NITEL/NTEL)

• ACE, WACS (via partnerships or regional consortiums)

So , Glo’s focus on being a wholesale bandwidth provider through GLO-1 might be one reason why their retail ISP service suffers in terms of customer satisfaction. They’re likely making more consistent revenue selling to institutions, ISPs, and data centers than from individual subscribers who demand high-quality, stable data service — which requires serious investment in towers, backhaul, and customer service

Copyright of Isaac Rocks Adeiza (Original Owner must be tagged to any Redistributions of content)

Content can’t not be redistributed for profit purposes.

Some users of CBEX, a digital asset trading platform, have dismissed trending reports that it has crashed.

This comes amid concerns over the operations of the platform, with some users warning that it showed signs of being a Ponzi scheme.

Our correspondent gathered that there are growing concerns about the platform’s stability, with many users fearing that their money is now stuck.

While some warned that CBEX could be a potential Ponzi scheme on the brink of collapse, others continued to defend the platform, insisting it remained a legitimate operation.

An X user, Viktor Benson (@viktorbensonyt), claimed that some users had been logged out of their accounts and might not be able to retrieve their money.

The post read, “You need to go to the platform to download the app and you tell yourself that platform is legit. Now you have put money and the website has crashed, and you can’t withdraw. Although people are saying that it is a temporary issue and I like being optimistic that by Monday one will be able to withdraw. Let us wait till Monday; hopefully, you can withdraw your money.”

Meanwhile, another X user, @BlessedAjoke, countered the crash claims, saying, “CBEX is still working perfectly, just that you can’t withdraw until the 15th of April. You people should stop spreading fake news. Stop giving people heart attacks nah.”

Another user, @0kparam, criticised those celebrating the platform’s possible collapse.

“Y’all are acting like CBEX crashing makes you financial sages. Nah, it just makes you bitter haters… Ponzi, yen yen yen. Just stfu, coward,” he wrote.

Speaking to Sunday Ekwutos, three other users confirmed that the platform was still functioning, although withdrawals were currently not possible due to the platform’s rules and regulations.

One of the users, Sodiq Dayo, said he was still actively trading on the platform and noted that the issue with withdrawals would be resolved by Tuesday.

“The platform is still working. The reason why the withdrawal is not functioning at the moment is because of some rules and regulations of the platform, and this will be resolved by Tuesday,” he said.

Another CBEX user, Alli Lanre, stated that as long as users could access the platform, there was no issue.

He advised users not to worry or develop hypertension over rumours of the platform’s crash.

Gbenga Adeboye, another user, expressed both optimism and pessimism, saying, “Basically, no one can withdraw unless the trading volume is completed. However, they promised the whole issue would be over by the 15th.”

Reacting to the issue, a financial expert, Aliyu Ilias, noted a regulatory gap in monitoring online financial businesses in Nigeria.

He stressed the need for continuous oversight from the National Information Technology Development Agency and the Central Bank of Nigeria to discourage unclear financial investments, whether Ponzi schemes or otherwise.

Ilias said, “Nigerians should be cautious of quick-income platforms that could crash at any point in time. The government has a responsibility to fish out the sponsors of these Ponzi platforms, even if they are operating in the cloud.”

A cryptocurrency expert, Kayode Olagunju, also emphasised that Ponzi schemes like CBEX should not be encouraged in the country.

He added that it was shameful that Nigerians continue to fall victim to scams despite the education and warnings provided by crypto experts.

“It is a slap in the face of intellectuals who have written so many articles and guides to help people with zero knowledge about cryptocurrencies. Crypto is vast; it is in the same class as the stock market,” he said.

Checks by our correspondent on the official website of the trading platform revealed that it remained accessible.

However, messages sent by Sunday Ekwutos to the email address listed on the CBEX website were undeliverable at the time of filing this report.

Police arrest singer Portable over alleged criminal defamation

Nigeria does not deserve leader like Tinubu – Atiku on US court order to FBI

Army decries poor enlistment from SE, urges youths to join military

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.