Business

Stop Interest Hiking, Experts Tell CBN As Apex Bank Raises Rate Again

Published

5 months agoon

By

Ekwutos Blog

By Chris UGWU, Kasarahchi ANIAGOLU Nov 27 2024

Some financial experts have said that the CBN’s 25 basis points rate hike signals a potential pause in interest rate increases starting next year, emphasizing the need for relief for small businesses facing high financing costs.

The Central Bank of Nigeria (CBN) had raised its interest rate by 25 basis points, increasing it from 27.25 per cent to 27.50 per cent, in response to the country’s rising inflation.

This decision was announced by CBN Governor Mr. Yemi Cardoso, who also chairs the Monetary Policy Committee (MPC), following their meeting in Abuja.

The MPC unanimously agreed to the hike as part of ongoing efforts to address inflationary pressures in the economy.

The analysts in an exclusive interview with THE WHISTLER noted that despite the CBN’s tightening measures, inflation remains high, with benefits mainly seen in exchange rate stability due to foreign portfolio inflows.

They agreed that the rate hike was expected due to rising inflation, warning that it will increase business financing costs, which could be passed to consumers and further strain household budgets.

Reacting to the development, Nigeria’s first Professor of Capital Market, Uche Uwaleke indicated that the move might signal an imminent pause in the CBN’s aggressive monetary tightening cycle.

Uwaleke noted that the marginal increase aligns with analysts’ expectations, suggesting a potential shift in the CBN’s strategy.

“The marginal rate increase is a signal that the CBN may completely pause or apply the brake on interest rate hikes starting from the first quarter of next year,” he explained.

The professor emphasized the necessity of a pause, citing the rising cost of funds and its adverse impact on credit access, particularly for small businesses. “This needs to happen so that small businesses can breathe,” he remarked.

Despite the CBN’s sustained tightening measures, headline inflation remains stubbornly high, reversing recent gains and rising further.

Uwaleke observed that the benefits of the rate hikes have been most apparent in the foreign exchange market, where increased foreign portfolio inflows have contributed to exchange rate stability in the official window.

However, the broader economic picture remains concerning. The Q3 2024 GDP report released by the National Bureau of Statistics (NBS) showed weak performance in the agriculture and manufacturing sectors, a development Uwaleke attributed to rising interest and exchange rates.

He stressed the need for coordinated efforts between monetary and fiscal authorities to navigate the country’s macroeconomic challenges effectively.

“The current macro-economic challenges make it imperative for a proper synergy between monetary and fiscal policies,” he advised.

Managing Director of Arthur Steven Asset Management Limited and former President of the Chartered Institute of Stockbrokers (CIS), Mr. Olatunde Amolegbe also shared his views on the Central Bank of Nigeria’s (CBN) decision to raise the Monetary Policy Rate (MPR) by 25 basis points, moving it from 27.25 per cent to 27.50 per cent.

Amolegbe noted that the rate hike was widely anticipated, particularly given the National Bureau of Statistics (NBS) report showing inflation had increased by over 100 basis points in the previous month.

“The truth is that this was somewhat expected,” Amolegbe stated, acknowledging that many analysts had predicted this adjustment, with some even anticipating a higher increase due to ongoing price instability across various sectors of the economy.

He further pointed out that the government’s fiscal and structural measures, aimed at curbing inflation, have yet to yield immediate results.

“These measures typically take time to have the desired impact,” he said, adding that as a result, monetary policy has remained the primary tool available to the CBN in its efforts to stabilize the economy.

“This leaves us with monetary policy as the only effective tool to prevent the economy from spiraling out of control,” he explained.

However, Amolegbe also warned of the potential negative consequences of the rate hike on businesses and consumers.

“The likely impact of this move will be a further increase in financing costs for businesses,” he stated.

These higher costs are expected to be passed on to consumers, potentially raising prices on goods and services and putting additional strain on household budgets.

Amolegbe concluded by emphasizing the delicate balance the CBN faces in managing inflation and ensuring that the economy does not overheat, while acknowledging the challenges that persist in the broader economic landscape.

Managing Director of Highcap Securities Limited, Mr. David Adonri also weighed in on the Central Bank of Nigeria’s continued use of interest rate hikes as a tool to manage inflation, noting that while effective in the short term, it remains insufficient in addressing the underlying economic issues.

In an exclusive interview, Adonri explained that interest rate adjustments are a critical component of monetary policy designed to curb inflation until more sustainable fiscal measures can be implemented to address the structural causes of economic imbalance.

“Interest rates are a potent tool for managing inflation in the short term,” Adonri stated.

“However, their effectiveness is often limited when coupled with expansionary fiscal policies,” he added.

He further emphasized that the ongoing fiscal expansion, alongside factors such as insecurity and currency depreciation, continues to fuel inflation.

These persistent challenges leave the CBN’s Monetary Policy Committee (MPC) with few options but to maintain its contractionary monetary stance.

“As long as fiscal policies remain expansionary and the factors driving inflation persist, the MPC will have no choice but to continue raising interest rates,” he explained.

Adonri also cautioned that allowing inflation to spiral out of control would have devastating consequences for both consumers and producers. “The impact of unchecked inflation would be far more harmful than the effects of higher interest rates,” he warned, underlining the importance of the MPC’s approach in preventing further economic instability.

Despite the negative effects on certain sectors of the economy, Adonri acknowledged that the interest rate hikes provide a silver lining for investors in debt instruments.

“The bonanza for investors in debt assets will continue as the rates rise,” he noted, as higher interest rates typically make fixed-income investments more attractive.

In conclusion, while the CBN’s monetary policy actions are necessary to address the current inflationary pressures, Adonri stressed the need for a coordinated effort between monetary and fiscal policies to tackle the structural issues contributing to inflation and ensure sustainable economic growth in the long term.

Meanwhile, Cardoso called for critical synergy between the monetary and fiscal sectors of the economy to achieve price stability and curtail inflationary pressures on food and other commodities.

According to Cardoso, food prices remain a key driver of inflation, compounded by rising energy costs that affect production factors.

“The recent increase in the price of Premium Motor Spirit (PMS) has also impacted the cost of production and distribution of food items and manufactured goods.

“The Committee was optimistic that the full deregulation of the downstream sub-sector of the petroleum industry would eliminate scarcity and stabilize price levels in the short to medium term.

“Members, thus, reiterated the need to deepen collaboration between the monetary and fiscal authorities to ensure the achievement of our synchronized objectives of price stability and sustainable growth.”

Cardoso highlighted members’ concerns over persistent exchange rate pressures, driven by continued high demand in the market.

Cardoso expressed satisfaction with the resilience and stability of the banking sector despite significant external and internal challenges.

He outlined key financial soundness indicators, stating that the “Capital Adequacy Ratio (CAR), Non-Performing Loan (NPL) ratio, and Liquidity Ratio (LR), among others, remain strong.”

You may like

Kano government uncovers ₦27.8m payroll fraud in local councils

NOTICE FROM INEC VOTER IDENTIFY CARD REVALIDATION

Kwankwaso: NNPP considering three options – Ladipo Johnson

Stop demarketing Nigeria – PDP chieftain tells Peter Obi

I never met Uzodinma to negotiate APC detection – Otti

Energy drink tussle: Court rules in favour of Mamuda Beverages Nigeria Limited

Business

Energy drink tussle: Court rules in favour of Mamuda Beverages Nigeria Limited

Published

3 hours agoon

April 26, 2025By

Ekwutos Blog

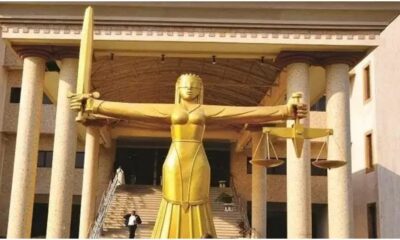

The Federal High Court sitting in Abuja has ruled in favour of Mamuda Beverages Nigeria Limited to first hear its preliminary objection to the suit filed against it by Rite Foods Limited before any other application in the matter.

In a ruling delivered on the 25th of April, 2025, Justice Emeka Nwite held that due to its decisive nature, the application challenging jurisdiction filed by Mamuda Beverages Nigeria Limited takes precedence over Rite Food Limited’s Motion Exparte. Thus, the Court would hear and determine it before taking any further step in the matter.

Rite Foods Limited approached the Court via Writ of Summons filed in Suit No. FHC/ABJ/CS/705/2025 to contest the production of Pop Power Energy Drinks over allegations that the drink has striking resemblance with one of its products.

The company through its lawyer, Booneyamen Lawal, SAN filed alongside the Writ, a Motion Exparte seeking preservative orders pending the hearing and determination of the substantive suit filed by it against the defendant, Mamuda Beverages Nigeria Limited.

The Motion Exparte was slated for hearing on 23rd of April, 2025. However, the defendant got wind of the application and swiftly filed through its lawyer, O.E.B Offiong, SAN, a preliminary objection challenging the court’s jurisdiction to entertain the suit.

In its preliminary objection, the defendant complained that Rite Foods Limited had on 28th January, 2025, filed a similar suit over the same issue and between the same parties which has already been decided by the court. It was stated that while not conceding to the allegations levied against it by Rite Foods Limited, Mamuda Beverages Nigeria Limited opted for settlement which was adopted by both parties and entered as consent judgment by the Federal High Court on 4th March, 2025. And that despite the consent judgment, the Plaintiff proceeded to file the instant suit against it, submitting that it amounts to abuse of court process, which robs the court of jurisdiction to entertain it. The defendant further communicated its concern to the plaintiff through a letter written on the defendant’s behalf by Aliyu & Musa Legal Practitioners & Consultants on 17th April, 2025.

On the said hearing date, Booneyamen Lawal, SAN led a team of lawyers in representing Rite Foods Limited, while O.E.B Offfiong appeared as lead Counsel on behalf Mamuda Beverages Nigeria Limited in company of 4 Senior Advocates of Nigeria and lawyers.

After announcing his appearance, Mr. Offiong drew the court’s attention to the preliminary objection filed on behalf of Mamuda Beverages Nigeria Limited, submitting that the court was bound to hear and determine it first, as it affects the jurisdiction of the court to entertain the suit.

Mr. Booneyamen disagreed with Mr. Offion’s position, submitting that the business of the day was hearing of the plaintiff’s Motion Exparte and that the defendant ought not be heard owing to the nature of a Motion Exparte which precludes service on a defendant or an appearance by such defendant.. He urged the court to proceed with the hearing of the plaintiff’s Motion Exparte.

Following lengthy arguments by both senior Counsel, the Court adjourned to 25th of April, 2025 for ruling on the application to be first heard by the Court.

The Court on 25th April, 2025, ruled in favour of the defendant, Mamuda Beverages Nigeria Limited, agreed with the position of its Counsel, Mr. Offiong, and held that owing to its decisive nature, the defendant’s preliminary objection challenging the court’s jurisdiction to entertain the suit has to be heard first before any other application in the matter.

In effect, the court held that the defendant’s preliminary objection takes precedence over the plaintiff’s Motion Exparte seeking preservatory orders.

The court finally adjourned the matter to 28th of May, 2025 for hearing of the defendant’s notice of preliminary objection.

Business

Air Peace set to resume flight operations

Published

1 day agoon

April 25, 2025By

Ekwutos Blog

Air Peace says it will resume flight operations on Friday following the suspension of strike by the Nigerian Meteorological Agency, NiMeT, workers.

This was contained in a statement by the airline’s Head of Corporate Communications, Ejike Ndiulo, on Thursday night in Lagos.

Ndiulo expressed Air Peace’s gratitude to its customers and the general public for patience, understanding and support throughout the period of the strike.

”Your resilience and trust in our brand mean the world to us.

“We commend the active and decisive intervention of the Minister of Aviation and Aerospace Development, Mr Festus Keyamo (SAN), whose leadership and commitment were pivotal in resolving the impasse and restoring normalcy within the aviation industry,” Ndiulo said.

He noted the minister’s swift engagement with aviation stakeholders, his transparent approach and his dedication to the stability and progress of the aviation sector.

Head of Corporate Communications further stated that Keyamo’s efforts not only facilitated timely resolution of the industrial dispute but also underscored his broader vision for a safer, more efficient and investor-friendly Nigerian aviation industry.

Ndiulo said Air Peace was committed to providing safe, reliable and world-class services.

Ekwutosblog reports that NiMeT workers on Thursday suspended the strike which began on April 22 after the minister’s intervention.

The workers downed tools in protest of alleged poor working conditions, including non-implementation of the 2019 Consequential Adjustment to the National Minimum Wage (affecting at least 30 staff).

They are also demanding a 25/35 per cent salary increase, 40 per cent hardship/peculiar allowance, and annual staff trainings.

The minister had promised to find lasting solutions to the problems.

Business

Aussie boss’s $2,000 mistake after using AI to write a work email

Published

1 day agoon

April 25, 2025By

Ekwutos Blog

- A cleaning company director introduced an AI tool to help write work emails

- Employees used the tool to try and shorten customer response time

A Melbourne cleaning company director has lost out on thousands of dollars after using artificial intelligence to help write a series of emails.

The business boss had hoped to improve his firm’s productivity, but one mistake alone cost it more than $2000 when he failed to pick up on the blunder.

End of Lease Cleaning Melbourne director Michael had introduced a generative AI tool to speed up the time it would take for his team to respond to customer emails.

Rather than have employees type out individual lists of cleaning services, they would input information such as the type of service required and let the tool do the rest.

The AI-powered tool would then generate an email that included the services, their costs and a job quote for each customer.

But the tool produced several emails with mistakes which were not picked up by the cleaning company’s employees.

‘We lost quite a lot of money,’ Michael told 9news.au.

The AI tool mistakenly listed different services to the ones required without changing the quotes to reflect the higher prices.

A cleaning company director lost out on over $2,000 after an AI tool to write emails (stock)

Michael and his team were forced to provide full wall cleans, priced between $500 to $700 for the price of a spot wall clean which is significantly lower.

The company’s most-costly mistake involved the director using the AI tool to generate a quote for property that required a deep clean worth around $2,000.

Michael read over the generated email but failed to spot several mistakes within the correspondence.

He didn’t spot the errors until a week later, by which time it was too late to correct them as the customer had signed up to a different company.

After the $2,000 mistake, End of Lease Cleaning Melbourne’s employees no longer use AI for business correspondence.

The response time for returning customers’ emails has now returned to five hours, the time it had previously taken prior to introducing the AI tool.

‘If you are using AI, you definitely need to read everything two to three times before you send that email,’ he added.

Almost half of all Australians use generative AI, according to a survey Google conducted with IPSOS in January.

According to a survey, around 65 percent of Australian workers said their employer had introduced AI in the workplace (stock)

Out of that 50 percent, almost 75 percent of those report using it for work.

In a separate survey carried out by HR platform Workday, around 65 percent of Australian workers stated their employer had introduced AI in the workplace.

Kano government uncovers ₦27.8m payroll fraud in local councils

NOTICE FROM INEC VOTER IDENTIFY CARD REVALIDATION

Kwankwaso: NNPP considering three options – Ladipo Johnson

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.