Business

Unity Bank posts N59.3B in gross earnings, grows deposits by 23% in 2023 FY

Published

1 month agoon

By

Ekwutos Blog

Retail lender, Unity Bank Plc posted gross earnings of N59.3 billion for the full year ended December 31, 2023, representing a growth of 3.84% year-on-year.

In its audited financials submitted to the NGX Group Limited, the Bank also witnessed improvements across key performance indicators, including a significant appreciation of customer deposits by 23% to N402.9 billion from N327.4 billion within the period under review – an indication of sustained retail growth and customer confidence.

Other key highlights of the full-year results include the total assets which stood at N472.5 billion; net fee and income commission, N5.2 billion and an increase in interest income by 9.6% to 53.7 billion from N48.8 billion within the period.

Commenting on the result, the Managing Director/Chief Executive Officer of Unity Bank Plc, Mrs. Oluwatomi Somefun said the Bank had issued a profit alert to reflectrevaluation loss arising from Naira devaluation which wasdue to acute shortage of Forex that created an inclementbusiness environment and, on the aggregate, set in an economic headwind. She noted, however, that in the full-year statement, this has bottomed out and the key performance indicators are rebounding from the low level of growth and negative trends that characterized the year.

Mrs. Somefun stated: “As we begin to see the margins being closed, it is an indication that the measures being taken to revamp all aspects of the business is being well received by the market: be it workable recapitalizationplan, aggressive drive for asset creation, product innovation, or digital banking”.

“We will need to covet the improvements and further build upon it. As a corporate brand, we have a lot that is keeping us going: the positive sentiments and optimism, the growing franchise of the business and steady growth in different segments of the retail market across all the geo-political zones of Nigeria”, She said.

She added, “We have the right indicators to reclaim lost grounds – innovating with the development and soon to be launched omnichannel digital app to improve reliability, customer experience, support diverse products functionality which will impact earnings, income and profitability.”

The Central Bank of Nigeria (CBN) has recently approved a business combination with another innovative Bank in Nigeria, marking a significant milestone in the Bank’s growth strategy as it advances its recapitalization plans. This partnership is built on a shared vision to redefine the banking experience for our customers and will drive the transformation of the consolidated entity. By leveraging Unity Bank’s extensive branch network and strong customer relationships alongside the entity’s digital expertise and commitment to innovation, we aim to create a seamless integration of traditional and modern banking services.

Amid a review of key highlights that support the steady growth of the retail business, analysts are of the view that the Bank has continued to reflect a good outlook in terms of perception and confidence in the market, which by and large creates an entity with remarkable resilience whilst investors’ sentiments remain positive.

You may like

I did only traditional marriage. Pls Atanda, how can i get a marriage c£rtificate that will be acceptable at the £mbassy?

Pope makes surprise appearance during Mass in St. Peter’s Square

Benue: Over 210 cows killed, stolen in Agatu – Youth group raises alarm

Protesters rally against Trump, Musk in ‘Hands Off!’ gatherings nationwide

Attacks on Plateau communities unacceptable – NSGF

Abia Govt Denies Alleged Engagement Of ESN To Fight Crime, Warns Against Fake News

Business

Dangote refinery, NNPC: More fuel stations increase pump price in Nigeria

Published

2 days agoon

April 4, 2025By

Ekwutos Blog

The price of Premium Motor Spirit, popularly known as fuel, has recorded a significant increase in the past days, which may worsen the economic hardship Nigerians face.

MRS, a filling station partner of Dangote Refinery, kicked off the latest fuel price increase when it adjusted its petrol pump to between N925 and N950 per litre in Lagos and the Federal Capital Territory, Abuja.

Similarly, other fuel marketers such as Empire Energy, Recoil, Juda Oil, Total, Emedab, and others also increased their fuel pump to between N950 and N970 per litre.

On Wednesday, the Nigerian National Petroleum Company Limited retail outlets also jacked up their fuel price to N950 per litre from N880 in Abuja.

Summarily, Ekwutosblog observed motorists will have to pay N70 more to buy a litre of petrol in the coming days.

The development comes amid the suspension of petrol product sales in Naira by Dangote Refinery. This follows the initiation of the naira-for-crude sale deal between Dangote Refinery and the federal government through NNPCL.

On Wednesday, President Bola Ahmed Tinubu announced a reshuffling of NNPCL.

Meanwhile, local oil prices are increasing in Nigeria, despite the decline in global crude prices. As of the time of this report, United States West Texas Intermediate was at $62.15 per barrel, down from above $65, while Brent crude stood at $65.42 per barrel, down from $72 last week.

Business

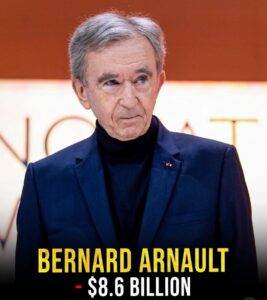

Global Billionaires’ Net Worth Plummets by $65 Billion Amid Market Downturn

Published

3 days agoon

April 4, 2025By

Ekwutos Blog

In a significant setback, the world’s wealthiest individuals collectively lost over $65 billion in net worth today, as key market sectors experienced a sharp downturn.

This decline affected prominent figures in technology, finance, and other industries, sending shockwaves through financial markets.

Ekwutosblog reports that the downturn occurs amidst cautious optimism that new US policies may not be as severe as initially feared.

However, the immediate impact has already been felt, leading to a decline in the net worth of billionaires such as Elon Musk, Warren Buffett, and Jeff Bezos, amongst others who have significant stakes in tech, finance, and other industries.

The global billionaire population has been growing, with over 2,850 individuals representing almost $15 trillion in wealth.

Despite this growth, the market downturn serves as a reminder of the volatility and risks associated with wealth concentration.

Business

Sterling Bank Makes History: Scraps Transfer Fees for Local Online Transactions, Earns Praise from Lawmakers, Including Mohammed Bello El-Rufai, and the Public

Published

3 days agoon

April 3, 2025By

Ekwutos Blog

Sterling Bank has taken a groundbreaking step to ease the financial burden on Nigerians by eliminating transfer fees and other charges for local online transactions.

This move is a significant stride towards financial inclusion and customer-centric banking, particularly during a time when economic pressures are high.

Ekwutosblog gathered that this initiative has been commended by Mohammed Bello El-Rufai, Chairman of the House Committee on Banking Regulations, who praised Sterling Bank’s commitment to creating a more accessible and equitable banking system.

El-Rufai encouraged other financial institutions to follow Sterling Bank’s example, emphasizing that a competitive banking sector prioritizing Nigerians’ interests will strengthen the economy and rebuild public trust in financial services.

Sterling Bank’s decision to scrap transfer fees is expected to benefit individuals and small business owners who frequently make online transactions. The bank’s customers can now perform local transfers via the mobile app without incurring any charges. Obinna Ukachukwu, Growth Executive at Sterling Bank, stated that access to one’s own money shouldn’t come with a penalty, highlighting the bank’s values-driven approach to customer-centric banking.

This move has sparked widespread public approval, with many calling on other banks to adopt similar policies.

As policymakers, El-Rufai reiterated their commitment to fostering a regulatory environment that encourages pro-customer initiatives while ensuring sustainability within the banking sector.

I did only traditional marriage. Pls Atanda, how can i get a marriage c£rtificate that will be acceptable at the £mbassy?

It’s wrong to check suspect’s phone – Ebonyi Police Commissioner

PRESIDENT TINUBU CELEBRATES DAME FASHOLA ON 60TH BIRTHDAY

Trending

Trending6 months ago

Trending6 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

- Business6 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

Politics6 months ago

Politics6 months agoMexico’s new president causes concern just weeks before the US elections

- Entertainment6 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

- Entertainment6 months ago

Bobrisky falls ill in police custody, rushed to hospital

Politics6 months ago

Politics6 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

Politics6 months ago

Politics6 months agoPutin invites 20 world leaders

- Politics1 year ago

Nigerian Senate passes Bill seeking the establishment of the South East Development Commission.